One benefit of working on projects for different clients and teaching workshops for a range of folks is the variety of questions asked. The discussions we end up having serve to remind us how acquiring, managing and selling timber and timberlands require specific skills to do so with minimum error and maximum profit. And how we come to learn and develop these skills can differ. Aunt Fanny, who continues to grow her timberland portfolio, gave me permission to share another of her stories about how she learned to evaluate timber markets when thinking about trading her cash and capital for tree-growing assets.

Aunt Fanny Thinks About…Making an Offer

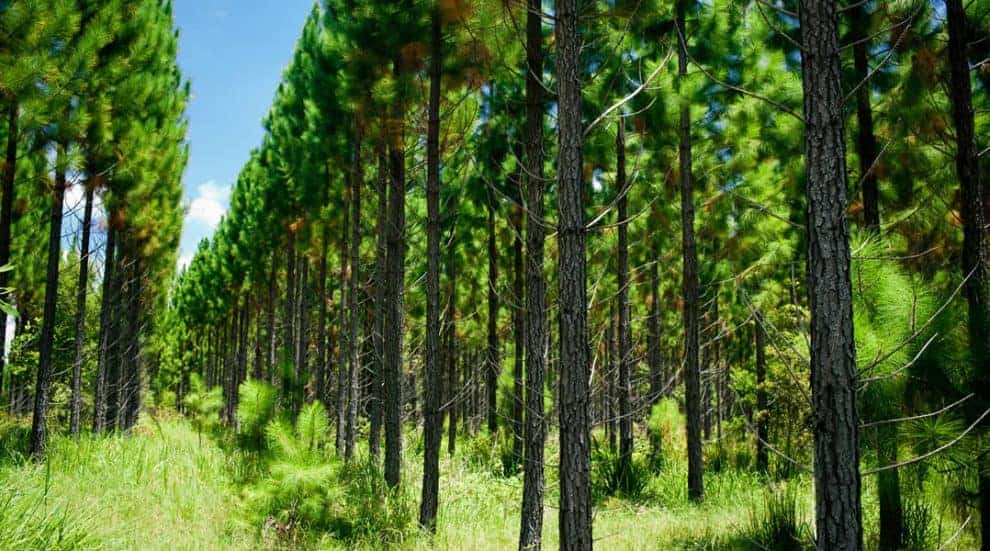

Aunt Fanny and I stopped near a small clearing in her forest where a large pine tree had fallen years ago. The tree had knocked down a few defenseless trees of lesser size, creating a gap in the canopy. Sunlight shined through down to the forest floor.

I pulled out my Star Wars thermos and poured out a cup of ice water, handed it to Aunt Fanny, and then took a swig straight from the thermos.

“Nephew, do you know Abe Phroman?” asked Aunt Fanny, looking out into the woods, sipping the cold water.

“Yes, he’s the Sausage King of Chicago,” I said.

“What are you talking about?” asked Aunt Fanny. Apparently, she had not seen “Ferris Bueller’s Day Off.”

“Sorry,” I said. “Old movie reference.” I cleared my throat. “You mean your neighbor?”

Exactly,” said Aunt Fanny. “Mr. Phroman is interested in selling some timberland.”

“You mean the 184 acres of loblolly pine adjacent to your property?” I said, nodding my head toward the property line.

“Well, I was thinking about making an offer,” said Aunt Fanny.

I hesitated. “Did you just say what I think you said?”

“Yes,” said Aunt Fanny. “I was thinking about whether or not to entertain this idea seriously. So how should I think about this?”

“Time for me to play professor again,” I said.

“Okay,” said Aunt Fanny, opening her black-and-white marbled composition notebook. “But be gentle. I’m not taking any quizzes.”

“Overall, assessing a potential timberland investment is straightforward,” I said. “And it starts with understanding the local market for wood. Timber markets are uniquely local.”

“What do you mean ‘uniquely local’?” asked Aunt Fanny, making quotes in the air with the hand holding her pen. The other hand kept the notebook open.

“It means the same timberland property in two different markets will have two different values,” I said. “You can have the finest timber in the world, but if you’re not close enough to mills that can buy your trees and turn them into something more valuable such as lumber or paper, your trees, from an economic standpoint, have little value.”

“Well that’s nice to hear,” said Aunt Fanny, frowning behind her aviator sunglasses.

“In this case, since Mr. Phroman’s property adjoins yours, we already know something about the local market,” I said. “It’s in your forest management plan.”

Aunt Fanny reached to a side pocket in her camouflage jumpsuit and pulled out a folded sheaf of papers. She flipped several pages and started to read, “Local timber markets within 100 road miles include seven pine sawmills, two pine plywood plants, one pole plant, four hardwood grade mills, two pulp mills and four chip mills.”

“So that gives us a starting point,” I said. “Now we’d need to confirm that those mills are open and interested in the kind of timber we’d be selling.”

“Makes sense,” said Aunt Fanny.

“Next, we would look closely at any data Mr. Phroman could share about his forest and we’d ask questions,” I said. “Forestry has a somewhat bizarre relationship with data. Everything is a sample. A forest cruise is a sample of what’s out there. Any timber price data is based on a sample of what’s going on in the market.”

“Would we do our own cruise to check the forest?” asked Aunt Fanny.

“There’s a good chance we would,” I said. “Because, in the end, we want to know what’s knowable. This helps us minimize any risks. We want to know, as best as possible, what we’re buying and the potential revenues and property taxes and management costs.”

“Whew,” said Aunt Fanny.

“In the end, we want to understand the individual property and the local timber market,” I said. “Timberland values depend on the local wood basin and the forest stocking of the properties.”

“Well, I guess we should go talk to Mr. Phroman,” said Aunt Fanny. “Life moves pretty fast. If we don’t stop talking to look around, we could miss an opportunity.”

This content may not be used or reproduced in any manner whatsoever, in part or in whole, without written permission of LANDTHINK. Use of this content without permission is a violation of federal copyright law. The articles, posts, comments, opinions and information provided by LANDTHINK are for informational and research purposes only and DOES NOT substitute or coincide with the advice of an attorney, accountant, real estate broker or any other licensed real estate professional. LANDTHINK strongly advises visitors and readers to seek their own professional guidance and advice related to buying, investing in or selling real estate.

Add Comment