Each year, when teaching Forisk’s Applied Forest Finance short course, I add content to address new or timely questions from forest owners and timberland investors. Over the past few years, this includes analysis related to forest carbon decisions and, more recently, timber leases.

What is a timber lease? In the book Forest Finance Simplified, I define timber leases as “contractual agreements that provide the lessors (owners) equal annual payments from the lessees (users) for use of their land to grow and harvest trees.”

A phone call with a retired veterinarian and forest owner in Louisiana about a 99-year lease had me revisiting this topic and definition. The nature and structure of timber leases offer a range of practical financial questions from which we can learn. For example, with the Louisiana lease, instead of equal annual payments, the original lessor received a single lump-sum payment from the lessees equal to $25 per acre 75 years ago.

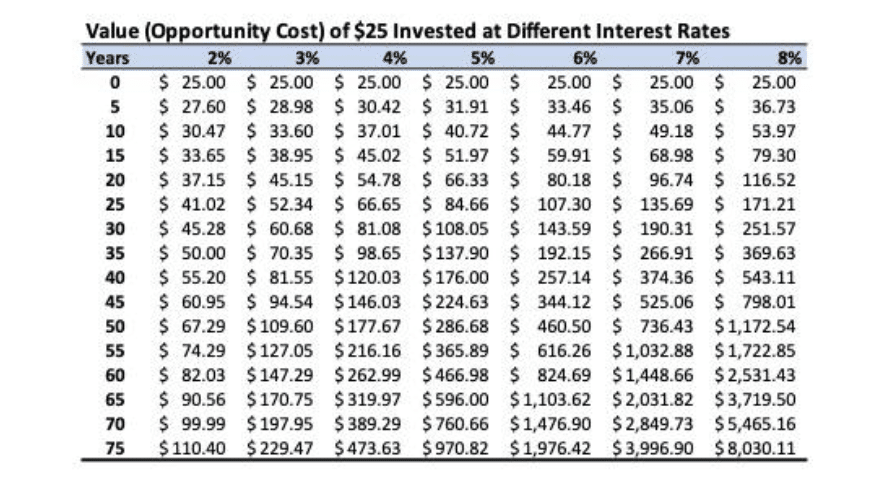

Investments have opportunity costs. Once we allocate capital, it is unavailable for other uses, so we want a perspective on how the decision could meet our financial objectives. What would that $25 be worth today if it was put into another, diversifying investment such as stocks or bonds? One approach to evaluate the financial implications of this timber lease is to consider how the $25 received 75 years ago must appreciate to cover our opportunity costs.

To do this, we can compare its future value across a range of interest rates over time (see table). These rates can be hypothetical or represent actual alternatives for our capital. As of March, 30-year U.S. Treasury Bonds yielded 3.92% and the dividend yields of publicly traded timberland-owning REITs ranged from 2.27% to 3.84%.

The table reinforces the power of compounded interest across rates and over time. At 6%, $25 approaches $2,000 in 75 years.

While I hear three primary reasons for owning or acquiring timberlands – to make money (investment), to manage risk (diversify a portfolio or secure wood supplies), and to recreate (huntin’ and fishin’) – they all benefit from understanding opportunity costs. How else could we use our resources to meet our objectives? What else could we do with our time or money? Which should we choose? Basic financial tools and frameworks help organize our thinking to make optimal decisions given our opportunities and what we know at the time.

This content may not be used or reproduced in any manner whatsoever, in part or in whole, without written permission of LANDTHINK. Use of this content without permission is a violation of federal copyright law. The articles, posts, comments, opinions and information provided by LANDTHINK are for informational and research purposes only and DOES NOT substitute or coincide with the advice of an attorney, accountant, real estate broker or any other licensed real estate professional. LANDTHINK strongly advises visitors and readers to seek their own professional guidance and advice related to buying, investing in or selling real estate.

Add Comment