The November 2015 announced merger of Plum Creek (PCL) and Weyerhaeuser (WY), the two largest public timberland-owning real estate investment trusts (timber REITs) in the United States, highlights the challenge of valuing timberland investments in public and private markets. The merger, expected to close in the first half of 2016, creates a firm with over 13 million acres and dozens of manufacturing facilities. The deal reminds us that analyzing timber REITs, versus pure timberland assets, extends beyond intrinsic value; it’s also an assessment of the supply and demand for the underlying stocks.

The proposed merger also speaks to the relative insignificance of timber firms to the REIT sector generally and the stock market overall. This article frames the announcement through providing context, to help us think through the implications for timberland investors and timber REIT shareholders.

Scaling the Merger to the Market

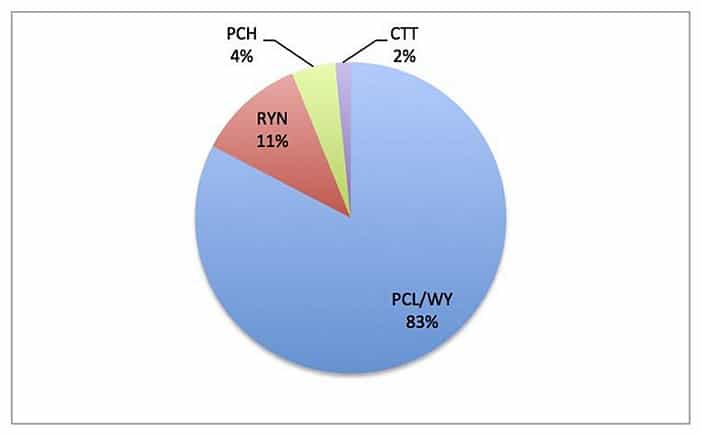

Prior to the merger announcement, Weyerhaeuser comprised 55% of the timber REIT sector’s market capitalization (outstanding shares multiplied by share price) per the Forisk Timber REIT (FTR) Index. Following a merger, the enlarged firm would account for 83% of timber REIT market cap (Figure 1), with Rayonier (RYN), Potlatch (PCL) and CatchMark Timber (CTT) comprising the balance. While each of the five public timber REITs holds a diversified portfolio of timberlands, the sector itself would be condensed and heavily concentrated.

Figure 1. Timber REIT Sector Market Capitalization by Firm (%)

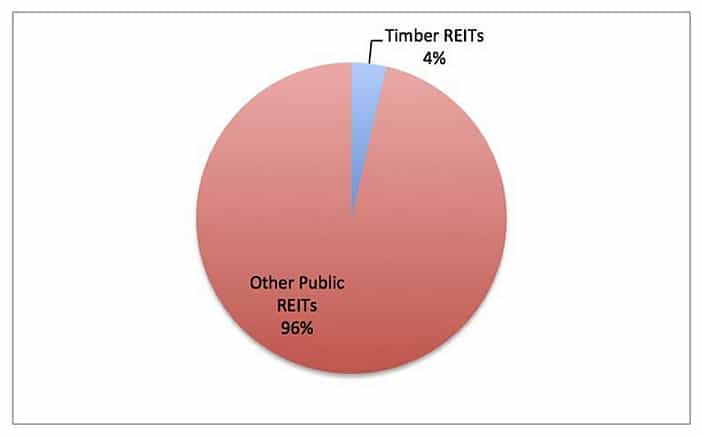

Scaling this group of timberland-owning firms to the public real estate (REIT) sector overall provides additional context (Figure 2). The five firms together comprise less than 4% of the total REIT sector’s ~$700 billion market cap. When we take the next step and compare this to the $19+ trillion dollar market cap for the S&P 500, the merger looks modest with respect to its market impact. Timber REITs are a niche within the REIT sector, and a “mini niche” within the market for U.S. public equities.

Scaling this group of timberland-owning firms to the public real estate (REIT) sector overall provides additional context (Figure 2). The five firms together comprise less than 4% of the total REIT sector’s ~$700 billion market cap. When we take the next step and compare this to the $19+ trillion dollar market cap for the S&P 500, the merger looks modest with respect to its market impact. Timber REITs are a niche within the REIT sector, and a “mini niche” within the market for U.S. public equities.

Figure 2. Timber REIT Market Capitalization within Total REIT Sector

Implications to Timberland Investors and Wood-Using Firms

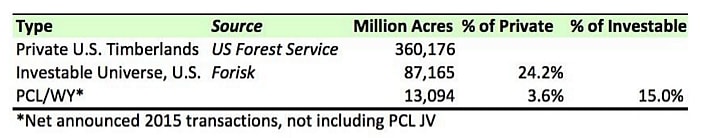

While the merger directly impacts employees of the firms, implications for timberland investors generally and wood-buying firms locally differ. A post-merger WY still accounts for a small portion of private U.S. timberlands, and a fraction of the “investable universe” of industrial quality assets in the country (Figure 3). While these acres do operate within a broader, actively managed space that includes millions of small and mid-sized private landowners, the question becomes one of local concentration.

Figure 3. U.S. Timberlands: Private, Investable and the PCL/WY Merger

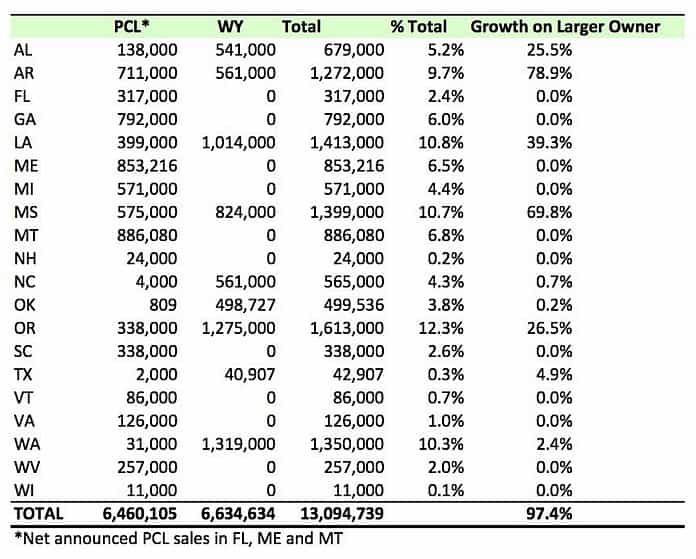

Localized timberland concentrations speak to these questions of strategy and operational efficiency. The merger marries a portfolio heavy to the Pacific Northwest with another weighted to the U.S. South. Many “spatial” synergies exist, meaning the portfolios are largely complementary. Of the 20 states involved, only five produce significant increases (25% or more) of owned timberlands (Figure 4).

Figure 4. State-by-State Breakdown of Proposed Merger

In sum, this data and analysis addresses two themes that affect two distinct audiences. The first puts the scale of the merger into context for both investors comparing timber REITs to alternatives, as well as to timberland focused investors and managers. Overall, while the deal reshapes the timber REIT sector, the sector is, was and remains small. Second, the real implications of this transaction occur in specific local markets and within the new organization itself. The “success” of the deal to Weyerhaeuser and its shareholders sits squarely on the firm’s ability to extract synergies and leverage the timberland portfolio efficiently.

This content may not be used or reproduced in any manner whatsoever, in part or in whole, without written permission of LANDTHINK. Use of this content without permission is a violation of federal copyright law. The articles, posts, comments, opinions and information provided by LANDTHINK are for informational and research purposes only and DOES NOT substitute or coincide with the advice of an attorney, accountant, real estate broker or any other licensed real estate professional. LANDTHINK strongly advises visitors and readers to seek their own professional guidance and advice related to buying, investing in or selling real estate.

It would be nice if you had posted a map of how is what and where