Our research and analysis of publicly-traded, timberland owning real estate investment trusts (REITs) tends to focus on the status of wood markets and the net asset values (NAV) of shares. The month of August, however, highlighted a different, and critical, theme related to operating timber REITs: financing. First, actions by ratings agencies provide an opportunity to revisit the “quality” of long-term debt associated with these firms. Second, Rayonier executed its planned stock split, providing an opportunity to summarize the impact on shareholders from the equity-related action.

Weyerhaeuser Outlook Raised

Last week, Fitch Ratings raised its outlook on Weyerhaeuser (WY) from “negative” to “stable” and affirmed its rating at “BB+”. Fitch justified the action primarily on the strength of Weyerhaeuser’s Pulp business and core Timberland operations, though the agency recognized that the firm’s financial performance continues to suffer from weak housing markets via its Wood Products and Real Estate businesses.

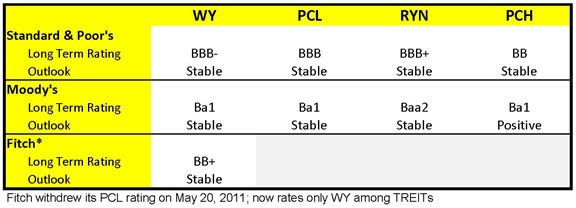

The table summarizes current ratings for the public timber REITs by the three major credit rating agencies: Standard & Poor’s (S&P), Moody’s and Fitch. The rating agencies do not make recommendations about buying or selling securities; rather their ratings are intended to provide independent, objective and informed opinions about the credit worthiness of each company.

In rating long-term debt, the agencies use alphanumeric letter grades, starting from “AAA” (extreme strong capacity to meet financial commitments) and ending at “D” (has been a payment default). Each letter grade has three notches and S&P uses + and – as modifiers. “BBB” and above are considered “Investment” grades and “BB” and below are considered “Speculative” grades. Ratings are subject to revision and the agencies update their outlook on a continuing basis. A “Positive” outlook indicates that the rating may be raised and a “Negative” outlook indicates that the rating may be lowered, while “Stable” indicates a neutral outlook.

Rayonier Splits Shares

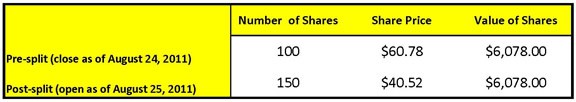

On July 25, 2011, Rayonier (RYN) announced that its board of directors approved a three-for-two stock split. On August 24, 2011, the company issued one-half additional share for each share held to shareholders of record as of August 10, 2011. Rayonier’s share price adjusted from $60.78 on close of August 24, 2011 to $40.52 on open of August 25, 2011 to reflect this split.

How does this split affect Rayonier shareholders? Technically, it doesn’t. Assuming a shareholder owns 100 shares of RYN pre-split and 150 shares post-split; the total value of these shares remains unchanged, as does RYN’s total market capitalization (see table). Both the size of the pie and the slice of the pie held by a shareholder do not change.

Why split? A stock split often occurs when companies have seen their share price increase to levels that look expensive relative to price levels of other companies in the sector. After the split, shares look more affordable and attractive to small investors, which can boost demand. The increased number of outstanding shares also boosts liquidity. Year-to-date, RYN has returned 15.38% to investors, while most other timber REITs have shown negative returns. In 2010, RYN’s share price appreciated 31.74%. Post-split, RYN’s share price ($40.40) looks more in-line with its peers, like Plum Creek-PCL ($ 36.34) and Potlatch-PCH ($32.99) as of close of August 26, 2011.

This content may not be used or reproduced in any manner whatsoever, in part or in whole, without written permission of LANDTHINK. Use of this content without permission is a violation of federal copyright law. The articles, posts, comments, opinions and information provided by LANDTHINK are for informational and research purposes only and DOES NOT substitute or coincide with the advice of an attorney, accountant, real estate broker or any other licensed real estate professional. LANDTHINK strongly advises visitors and readers to seek their own professional guidance and advice related to buying, investing in or selling real estate.

Add Comment