What a difference a century can make. One hundred years ago, forestry in the United States featured massive wildfires, aggressive conversion to agriculture, and harvest levels exceeding timber growth. Today, while we still have wildfires, the forest sector is characterized by more intensive management and forest growth markedly exceeding harvest levels. Timberlands also feature high levels of institutional ownership.

Forisk has a special research interest in timberland investment vehicles and in teaching applied forest finance workshops. In 2008, we registered the FTR (“footer”) Index to benchmark the timber REIT sector. Each week, we publish a one-page (Forisk Timber REIT) FTR Weekly that compares timber REITs to other assets.

Timberland Owning Real Estate Investment Trusts (Timber REITs)

The number of public timber REITs in the U.S. changed in 2022, as the sector consolidated from four firms to three when PotlatchDeltic (PCH) merged with CatchMark Timber Trust (CTT) in an all-stock transaction. (For reference, the number of public timber REITs has fluctuated between two and five since 2004. Plum Creek was the sole timber REIT from 1999 through 2003.)

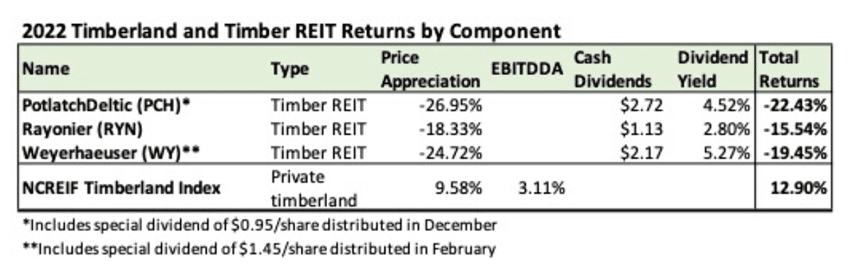

How did timber REITs perform in 2022? According to the FTR Weekly, timber REITs returned -22.75% based on appreciation and -18.51% on a total returns basis (versus 25.09% on appreciation and 30.12% for total returns in 2021). How did this compare to private timberlands owned by institutional investors? Timberlands returned 12.90% in 2022 (versus 9.17% in 2021). The figure below compares the 2022 performance of the public timber REITs to private timberlands as tracked by NCREIF.

The price appreciation for the timber REITs assumes investors bought shares on December 31, 2021 and sold them on December 30, 2022 (the last trading day of the year). The dividend yields are based on the share price upon acquisition.

Historic Context

While the strong 2022 private timberland returns catch the eye, the 31.4% gap (12.9% vs -18.50%) between those and the total returns for timber REITs generate questions about the relative and historic performance of these investment types. The last time private timberlands and public timber REITS, based on total returns, moved so strongly apart was in 2008 when NCRIEF gained 9.5% (after increasing 18.4% in 2007) and the FTR Index fell 20.4%, a gap of 29.9%.

This content may not be used or reproduced in any manner whatsoever, in part or in whole, without written permission of LANDTHINK. Use of this content without permission is a violation of federal copyright law. The articles, posts, comments, opinions and information provided by LANDTHINK are for informational and research purposes only and DOES NOT substitute or coincide with the advice of an attorney, accountant, real estate broker or any other licensed real estate professional. LANDTHINK strongly advises visitors and readers to seek their own professional guidance and advice related to buying, investing in or selling real estate.

Add Comment