Forest carbon opportunities profit from markets which trade on the mismatch between energy use (what we consume) and the greenhouse gas emissions associated with current industries (what we produce and how). In theory, like a diet based on counting calories or a monthly budget of household expenses, the math of forest carbon contracts is easy, something we cover in our Applied Forest Finance workshops. However, like a diet or household budget, a forest carbon plan can be hard to put into practice.

The understanding of and markets for forest carbon remain in progress. Carbon capture and storage by trees varies based on forest age, trees planted per acre and management approach. Compare the active CO2 sequestration of younger virile and established forests with the slow CO2 intake and release by old stands, dying trees and forest fires.

Also, the potential for narrow views and limitations from evolving carbon markets frustrates forest industry decision-makers. As noted to me by others, the rapid growth in U.S. voluntary carbon markets, with their variety of requirements, and the associated supply increase in forest carbon credits, has resulted in falling prices for these credits in some programs.

Revisiting Forest Carbon Benefits

Let us then step back and consider a broader view that says forest carbon benefits do not end “in the woods.” The optimal path for capturing carbon includes active, sustainable forest management and harvesting combined with the production of solid wood products. Well managed forests plus the use of long-lived wood products leverages the portfolio of carbon storage possibilities from trees throughout the supply chain and across the economy.

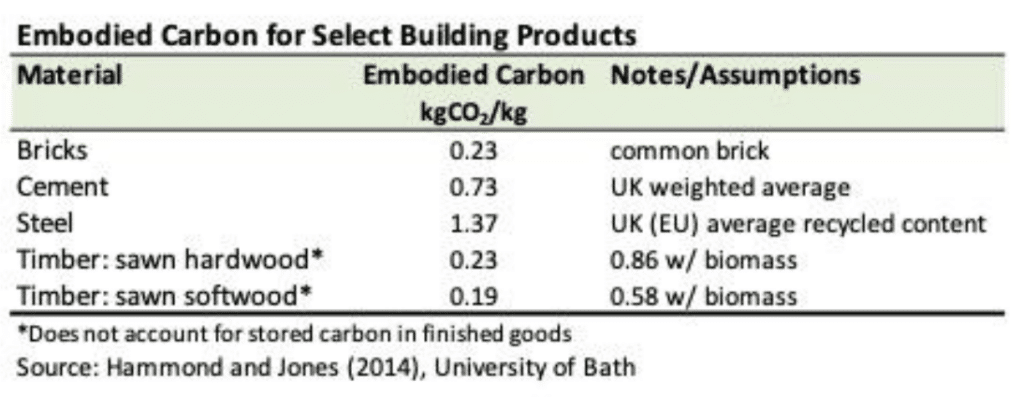

Wood products perform well relative to other building materials in comparisons of embodied carbon, which estimate in kilograms of CO2 per kilogram of product the carbon emissions for its life cycle, from extraction to manufacturing and, finally, disposal. Research at the University of Bath in the UK supports the Inventory of Carbon and Energy (ICE) open-access data for embodied energy and carbon associated with a range of construction materials. The table compares a few products to lumber.

The table highlights the low (that’s good) embodied carbon associated with timber versus steel, in particular. However, even this understates the relative benefits of wood. For example, the ICE database focuses on “cradle-to-gate” versus “cradle-to-grave.” This means that for timber products, the data does not account for the benefits of carbon storage, which would further reduce the embodied carbon factors.

Overall, wood-framed homes use less energy than steel or concrete projects, even accounting for hauling inbound and out, and does more, on a relative basis, to reduce greenhouse gas emissions. Once that reality is combined with sustainable forest management practices, we can see, on paper at least, how forest carbon provides opportunities for investors and firms interested in assessing the “portfolio of options” available to them, from forest management to solid wood products.

This content may not be used or reproduced in any manner whatsoever, in part or in whole, without written permission of LANDTHINK. Use of this content without permission is a violation of federal copyright law. The articles, posts, comments, opinions and information provided by LANDTHINK are for informational and research purposes only and DOES NOT substitute or coincide with the advice of an attorney, accountant, real estate broker or any other licensed real estate professional. LANDTHINK strongly advises visitors and readers to seek their own professional guidance and advice related to buying, investing in or selling real estate.

Thank you for this article. Of course, environmental protection and sustainability are important. Even essential for the survival of our society.

Trading pollution rights or CO2 certificates will not last long. In the background, other interests play a role that will soon be obsolete.