For investing, as in sports, it comes down to measurable performance. And for investing, as in sports, relative performance dictates success. How did we perform relative to the other team on the field, the other country in the Olympics or the other assets in our portfolio? For timber assets, the scores are in for 2013. How did public and private timberland investments perform?

Timber Investment Performance in 2013

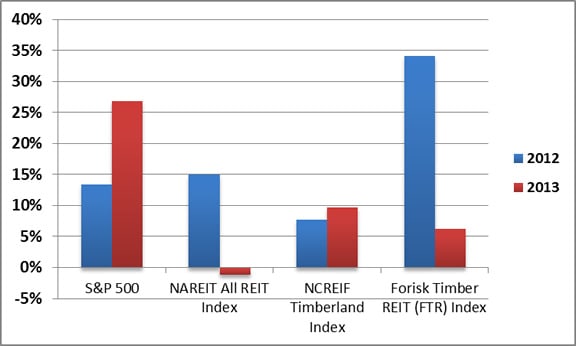

The National Council of Real Estate Investment Fiduciaries (NCREIF) reported 2013 total returns for private US timberlands of 9.69%. Figure 1 compares, for 2012 and 2013, the performance of indices tracking the S&P 500, all publicly-traded real estate investment trusts (NAREIT), private timberlands (NCREIF) and publicly-traded timberland-owning REITs (FTR). The timber REITs in the FTR Index include Plum Creek (PCL), Potlatch (PCH), Rayonier (RYN) and Weyerhaeuser (WY).

Figure 1. Timber Investment Indices Relative to Other Assets, 2012 and 2013

Taxing Timber REIT Dividends in 2013

The IRS Tax code requires real estate investment trusts (REITs) pay out at least 90% of their taxable income to shareholders as dividends. In exchange, the IRS does not levy corporate taxes on this REIT income; taxes are paid – once – by shareholders on the dividends. This single-taxation of REIT income represents a key benefit and attraction to investors.

Timberland-owning REITs enjoy an added benefit. Most timber REIT distributions (related to income from the sale of timber) are treated as long-term capital gains and taxed at relatively lower 15% tax rates compared with ordinary dividends (for those in the top 39.6% ordinary income tax bracket, the 2013 capital gains rate is 20%). Recently, the four public timber REITs announced the tax treatment of dividends paid in 2013 (Figure 2):

Figure 2. Tax Treatment of Timber REIT Distributions, 2013

|

Total Distribution per Share (2013) |

Total Capital Gains Distributions |

Qualified Dividends |

|

| Potlatch |

$1.28 |

$1.28 |

|

| Plum Creek |

$1.74 |

$1.74 |

|

| Rayonier |

$1.86 |

$0.72 |

$1.14 |

| Weyerhaeuser |

$0.81 |

$0.81 |

For Plum Creek, Potlatch and Rayonier, 100% of dividends paid in 2013 will be treated as capital gains. For Rayonier shareholders, $1.14 (61.29%) will be treated as ordinary dividends while $0.72 (38.71%) qualify as capital gains.

While publicly-traded timber REITs, as measured by the Forisk Timber REIT (FTR) Index, crushed the field in 2012 with returns of 34.12%, the S&P 500 captured the yellow jersey in 2013 with a 26.90% gain. The summary results, though capturing an arbitrary snapshot, remain consistent with the timberland investing thesis that direct ownership of timberlands provides superior capital preservation and diversification and stability, as reflected in balanced returns for 2012 and 2013. Alternately, public timber REITs offer, tax advantages relative to other REITs, superior liquidity and total returns over time with more risk as equity values can and will dive with the overall market.

This content may not be used or reproduced in any manner whatsoever, in part or in whole, without written permission of LANDTHINK. Use of this content without permission is a violation of federal copyright law. The articles, posts, comments, opinions and information provided by LANDTHINK are for informational and research purposes only and DOES NOT substitute or coincide with the advice of an attorney, accountant, real estate broker or any other licensed real estate professional. LANDTHINK strongly advises visitors and readers to seek their own professional guidance and advice related to buying, investing in or selling real estate.

Well done.