During the first half of 2015, Amanda Lang led a project for the Forisk Research Quarterly (FRQ) that analysed global pellet demand and the implications for pine pulpwood prices across local timber markets in the U.S. South. Specifically, the research addressed the question, “how might projected changes in wood pellet demand influence local pine pulpwood stumpage prices?”

Global Wood Pellet Demand

Wood pellets serve two primary markets: residential for producing heat in homes, and industrial power plants for generating electricity. While current U.S. demand for pellets is exclusive to the residential market, the U.S. emerged as a leading exporter of wood pellets from the South when wood pellets emerged as an option for reducing global carbon dioxide emissions at power plants.

What does “global demand” for wood pellets look like? Forisk projects world demand for industrial wood pellets to grow from 10.6 million metric tons in 2014 to 25.0 million metric tons in the next five years, based on actual announced power plant conversions. The largest projected increases are in the UK and Denmark. U.S. export pellet capacity could increase from 5.0 million metric tons in 2014 to 10.7 million metric tons by 2019, based on project announcements that pass Forisk’s “viability” screening.

Projections indicate that U.S. wood pellet capacity would exceed the demand for U.S. wood pellets in the next three years, effectively “running ahead” of demand. What are the implications? First, pellet plants that plan to start-up in 2016 and 2017 will likely be delayed by one year. Second, it is unlikely that additional export-focused pellet plants will be announced in the U.S. The players are at the table.

Local Timber Prices

Adding demand impacts timber prices. Three demand factors drive local price changes: new wood bioenergy projects; oriented strand board (OSB) capacity; and high volumes of softwood sawmill residual chips, which serve as a pulpwood substitute. Pulp and paper has always been and will continue to be the dominant user of pulpwood and chips in the South. In fact, pulp and paper account for approximately 80% of the pulpwood demand in the South in 10 years.

Forisk projections of total pulpwood and chip use in 2019 and 2020 align with peak historic consumption in 1997 and 1998. So, pellet demand is basically replacing “lost” demand from pulp/paper at a South-wide level. Also, increased sawmill residual chips reduce projected pine pulpwood stumpage prices, wherever they end up in the base forecasts, by $1.40 per ton on average.

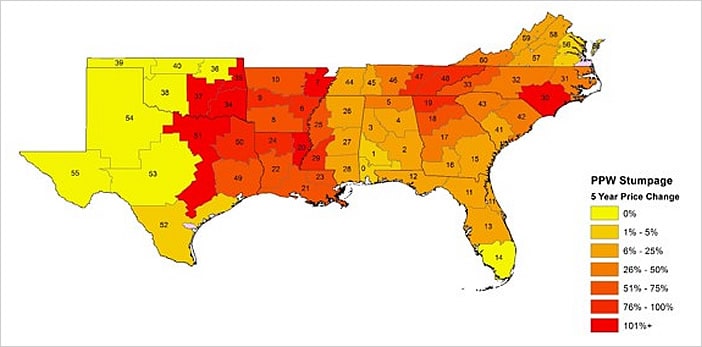

Of course, price changes vary locally. The figure below, which does not include potential “relief” from increased residual chip supplies, highlights significant, estimated increases for pine pulpwood stumpage in the East Texas and Louisiana regions. This corresponds with large percentage increases in demand relative to today, while the larger, higher volume coastal markets are better able to absorb demand growth.

Heat Map of Pine Pulpwood Stumpage Price Changes in Five Years (2019)

Increased demand from bioenergy plants could increase average stumpage prices in the U.S. South by 31% in the next five years, assuming no effect from increased residual chip supplies. Effects vary greatly by state, from 0% price growth from bioenergy in Alabama and Tennessee to 50-55% in Mississippi and Arkansas, and 84% in Louisiana. Existing forest industry plants and announced capacity improvements at OSB and pulp/paper mills increase stumpage prices by an average of 19% for the South. North Carolina, Tennessee, Arkansas, and Texas have the greatest impacts from forest industry demand changes. It is important to note that price increases will be lower than reported here as residual chip supplies increase.

Once a small-scale industry that bagged pellets for homeowners to purchase in hardware stores, the U.S. wood pellet sector has evolved into a large-scale producer of pellets to ship across the Atlantic Ocean for power production. The current situation has unique features. Forest supplies look different locally: today, because of aggressive thinning and targeted pulpwood harvests during the recession, many local markets exhibit temporary tightness in pulpwood supplies. Wood users continue to wait for relief from increased residual supplies from sawmills. Politics matter: in projecting global pellet demand, we acknowledge the unpredictable yet impactful nature of regulations and legislative targets. Finally, markets and consumers adapt.

This content may not be used or reproduced in any manner whatsoever, in part or in whole, without written permission of LANDTHINK. Use of this content without permission is a violation of federal copyright law. The articles, posts, comments, opinions and information provided by LANDTHINK are for informational and research purposes only and DOES NOT substitute or coincide with the advice of an attorney, accountant, real estate broker or any other licensed real estate professional. LANDTHINK strongly advises visitors and readers to seek their own professional guidance and advice related to buying, investing in or selling real estate.

When USA begins exporting nat gas, I believe this will change the economics of fuel for energy production.