Over the past 50 years, major shifts in the regional distribution of lumber capacity across North America followed from natural and legislated disruptions in forest supplies. The details vary, including reduced harvesting on public lands in the Pacific Northwest; insect infestations in Western Canada; and abundant forest supplies and growing markets in the U.S. South. Regardless the motives and explanations, the resulting and massive shift of softwood lumber capacity across North America affects how timberland owners and investors think about managing the assets they own.

Forisk’s research into mill capacities and capital investments, now available in a new digital platform for the North American Mill Capacity Database, reminds us how the “iron goes to the resource.” This article summarizes the current situation, with historic context, for the softwood lumber sector in North America.

Lumber Capacity Changes Over Time: The Data

Since 2009, North America added over 6 billion board feet of softwood lumber capacity, net including closures. This nine percent increase understates the regional variances, as the South increased by more than 60% (>11 BBFT), Western Canada lost over 25%, and the Pacific Northwest (U.S. West) shrunk by nearly 11%. The U.S. South went from accounting for 25% of North American softwood lumber capacity in 2009 to 38% as of mid-2024. According to analysis by Pat Jolley and Amanda Lang at Forisk, this percentage for the South will grow by year-end simply based on known, in-progress investment activity.

Lumber Capacity by Region: Current Distribution and Profile

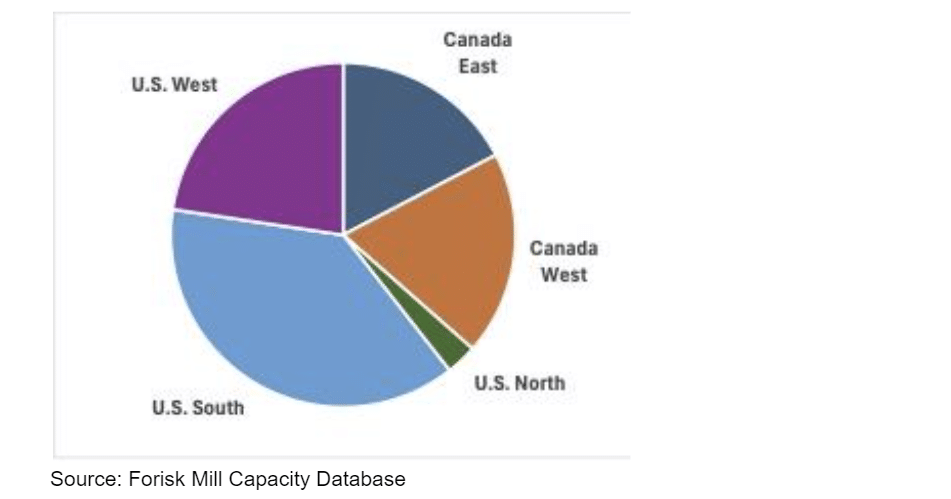

The pie chart below summarizes the current distribution of softwood lumber capacity by geographic region. As of July 2024, the U.S. South leads with 38% of North America’s softwood lumber capacity. Adding the U.S. West and Western Canada, which includes British Columbia and Alberta, raises that to 80%. Of all North American regions, these have the merchantable softwood inventories best suited for softwood lumber manufacturing.

North American Softwood Lumber Capacity by Region (as of July 2024)

The nature and structure of sawmill capacity has changed. The number of sawmills has decreased, and the average softwood sawmill size has increased. While multiple regions have increased capacity – U.S. South, U.S. North, and Eastern Canada – the South is unique with respect to the volume and scale of this growth through the substantial addition of new sawmills.

On this point, scale leverages technological advances in the forest products industry, and industry consolidation further leverages those benefits. The ten largest softwood lumber producers in North America have not changed much with respect to the “who” over the past fifteen years, but their share of North American capacity has increased. In 2009, the top ten went from 28.8 BBFT of North America’s capacity (42% of North America’s total) to 36.9 BBFT today (49% of North American capacity).

For timberland owners and investors, the regional shifts in wood-using capacity emphasize the importance of looking immediately at the localized mix of wood markets when conducting due diligence and revisiting forest management plans. From an economic standpoint, the value and cash-flow potential of a tree-growing investment depends on the health, diversity, and competitiveness of local wood-using mills.

To learn more about the Forisk Research Quarterly (FRQ) or the North American Mill Capacity Database, please email Nick DiLuzio at ndiluzio@forisk.com.

This content may not be used or reproduced in any manner whatsoever, in part or in whole, without written permission of LANDTHINK. Use of this content without permission is a violation of federal copyright law. The articles, posts, comments, opinions and information provided by LANDTHINK are for informational and research purposes only and DOES NOT substitute or coincide with the advice of an attorney, accountant, real estate broker or any other licensed real estate professional. LANDTHINK strongly advises visitors and readers to seek their own professional guidance and advice related to buying, investing in or selling real estate.

Add Comment