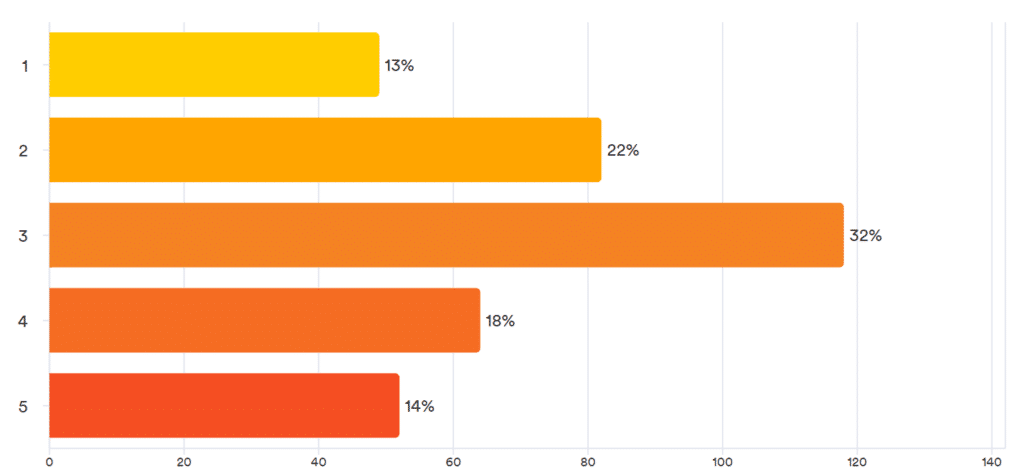

According to the June LANDTHINK Pulse results, most respondents rate the current land market relatively the same as June 2022. Based on the chart below, with 1 being Softer and 5 being Hotter, 32% rated the market a 3 compared to last year, followed closely by 22%, who rated the land market a 2 compared to last year. Many respondents (18%) rated the current land market a solid 4. Needless to say, most feel the land real estate market has been holding steady after the turbulent market conditions of 2022 commenced.

Last month, the June Pulse asked: Compared to June 2022, how would you rate the current land market?

While the real estate housing market on a national scale has seen prices and sales decline since the all-time highs of mid-2022, the land market has remained largely unaffected. Land market predictions for the back half of 2023 are a topic of much debate among industry experts. While there is no consensus on whether the historically tight market will loosen or not, it is evident that the market has cooled significantly from its previous highs. Despite initial concerns of a market crash comparable to the Great Depression due to the pandemic, the housing and land market has remained stable. However, there are key factors to consider, such as rising prices and potential declines in sales due to the substantial imbalance of low land inventory and high buyer demand.

The main driver of the market’s cooling from its peak last year is higher mortgage rates and recession fears. Nevertheless, there are other factors that may influence the market’s pace and favorability for both buyers and sellers. The land market is subtly shifting from being heavily skewed towards sellers, moving towards more balanced conditions. Buyers are still showing strong interest resulting in a somewhat competitive market, especially for properties that are priced attractively and possess desirable features.

Back in June of 2022, Fed chair Jerome Powell announced plans to “reset” the housing market, increasing the likelihood of falling home prices. As the Fed has increased interest rates to tame inflation, the housing market and land market started to slow down. Cut to June 2023, and inflation is taking its sweet time in returning to the Federal Reserve’s end goal of 2%. Add in bank failures, recession fears and a labor market that refuses to break, and you’ve got a perfect recipe for stubbornly-high rates.

Mortgage rates in 2023 into 2024 will likely play a significant role in determining the decline in home values. Interest rates have a substantial impact on the housing market, but less impact on the land market. Interest rates influence mortgage payments, housing demand, and prices.

Two more increases to the federal funds rate are likely this year, which won’t help bring rates down anytime soon. Experts now believe mortgage rates will remain between 6% and 7%, slowly declining toward a range of 6.5% and 6.1% by year’s end.

Because of an increase in cash purchases in the past two years, the land market will see fewer negative affects of rising rates. The uneven economic impact of the pandemic allowed some buyers to save more money, investors to see substantial stock market gains and homeowners to receive top dollar for their properties. All of these factors contributed to an increase in cash buyers. Land price growth has slowed, but the lack of enough inventory to satisfy buyer demand has kept prices reasonably stable.

Land investment may not be as common as residential real estate, rental properties, or REITs, but it’s looking like a solid choice in 2023, and beyond. Investments in land have steadily increased over the last decade. Investors may purchase land for agricultural purposes, timberland, residential and commercial real estate. Regardless of the purpose, all types of land for sale are in demand.

Investors that prefer stability and control rethink stocks in an uncertain economy and look at safer, non-traditional ways to diversify their portfolio. Land real estate is usually the answer if they are in the market for a solid, long-term investment. Hard assets like timberland and farmland are a good hedge against both inflation and economic downturns and can provide a continuous cash flow from leases and timber income, as well as tax benefits. In the last two recessions, both outperformed the stock market. Land has historically shown appreciation in value. Most land buyers have long term goals and financial plans, and they understand the ups and downs that come with owning hard assets.

Land is a long-term investment, not a short-term trade. And that makes it different from other types of real estate. The market forces pushing prices now rarely last long term. So, investors need to be looking at long-term trends, not just whether the market is hot or not today.

Despite the uncertainties created by the economic climate, land is still proving to be an attractive investment. Remember that a lot of the value of buying land comes in the long term, holding a property and letting time grow your investment. Land sale trends rarely show any decrease over the long term and tends to stay the same or gradually increase over time. Many of the nation’s wealthiest people put their money into land for this reason- to keep it safe.

The real estate land market 2023 is heading toward a more stable and secure future. The market will still be competitive, and buyers will need to be prepared to act fast when they find a property they like. Now is the time to take advantage of opportunities in the land market and reap the benefits.

Do you have a suggestion for next month’s Pulse question? Submit your question and we might choose yours!

This content may not be used or reproduced in any manner whatsoever, in part or in whole, without written permission of LANDTHINK. Use of this content without permission is a violation of federal copyright law. The articles, posts, comments, opinions and information provided by LANDTHINK are for informational and research purposes only and DOES NOT substitute or coincide with the advice of an attorney, accountant, real estate broker or any other licensed real estate professional. LANDTHINK strongly advises visitors and readers to seek their own professional guidance and advice related to buying, investing in or selling real estate.

Add Comment