Last month, the LANDTHINK Pulse posed the following question to our audience: What will happen to land inventory in 2025?

The real estate market is at a critical juncture, shaped by a confluence of new policies, economic challenges, and shifting demand patterns. The nation faces a housing deficit exceeding 4.5 million homes, compounded by the high cost of construction materials, labor shortages, and policy uncertainty. While policymakers are exploring ways to increase affordability and supply, recent election outcomes are poised to redefine the market.

The real estate land market is equally challenging right now. Land prices are in a seemingly constant climb, interest rates remain stubbornly high (at least compared to rates a few years ago), and overall land inventory remains woefully low, which only compounds the problem.

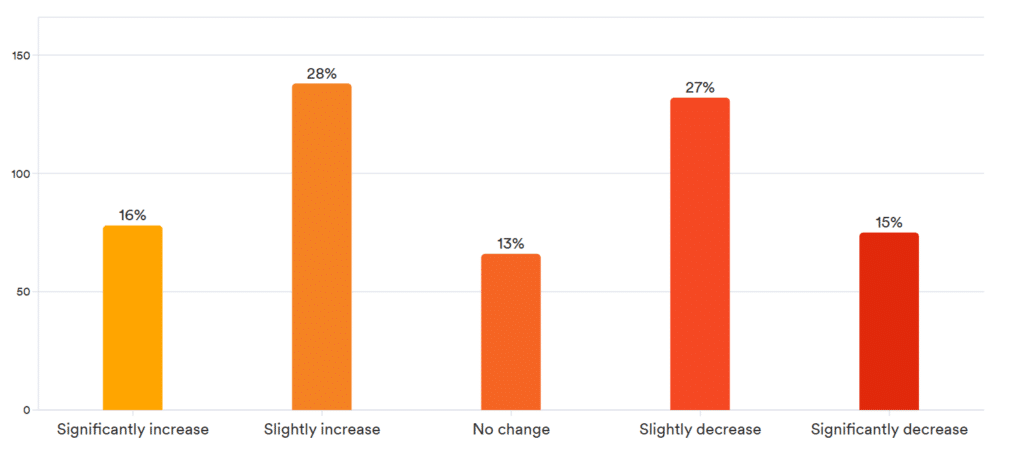

Will land inventory rise in 2025? The LANDTHINK audience certainly expressed mixed views on what will happen to land inventory as our informal online survey revealed. The results were all over the board, but the largest percentage (28%) indicated that land inventory would SLIGHTLY INCREASE followed closely by 27% of our audience, who said land inventory would SLIGHTLY DECREASE.

When inventory is low, buyers are forced to compete for the limited properties that are out there, driving up prices and making landownership less attainable across the board. Throw in high rates and the challenge gets steeper.

With Donald Trump re-entering the Oval Office yesterday, certain demographics are optimistic about the 2025 land market and the possibility of a bump.

Land inventory has been low for years. President-Elect Trump pledges significant policy shifts upon his return to the White House.

Here’s how land inventory may increase in 2025:

1031 Exchange Will Be Preserved

With a Trump Administration, we can feel confident that the 1031 Exchange will not only be preserved but could even be strengthened as part of a broader pro-growth agenda.

The 1031 Exchange enables investors to defer capital gains taxes when selling and reinvesting in like-kind properties. This process fuels reinvestment, job creation, and economic development, all of which align with pro-business policies. President Trump is heavily invested in the real estate space, and it’s likely he recognizes the 1031 Exchange as a fundamental tool for stimulating property transactions and bolstering the real estate market.

The 1031 Exchange is essential for many investors, not only because it helps with deferring capital gains taxes but also because it creates a more dynamic market. By allowing capital to flow more freely, investors can move their assets to more profitable opportunities, whether it’s upgrading to a better property, diversifying portfolios, or expanding investments across different regions. All of this spurs more growth, employment, and economic vitality within the market.

A 1031 exchange can potentially increase land inventory by allowing investors to sell one property and reinvest the proceeds into a new, “like-kind” property, essentially freeing up the previously owned property for sale on the market while simultaneously acquiring a new investment property, thus contributing to the overall land inventory available for purchase.

Possible Repeal or Reduction of Capital Gains Tax Increases

In recent years, there has been talk of increasing capital gains taxes for high earners, which would significantly impact real estate investors who rely on asset appreciation for returns. Trump, however, has voiced support for maintaining or even reducing capital gains taxes, which could benefit real estate investors looking to buy and sell properties.

A Different Type of Land Buyer has Emerged

When interest rates are high, inventory tends to remain low because it becomes more expensive to borrow money, leading to less buying activity, which in turn discourages sellers from putting their property on the market.

Interestingly, the rural land market operates differently from the general housing market, and experiences its own unique trends. In general, land buyers are less concerned with interest rates.

More buyers are skipping the land loan. With the sizable housing equity gains many owners have experienced, all-cash buyers have surged to record highs. All-cash purchases are making up a big piece of the land-buying pie for two major reasons: first is affluent Americans who can afford to pay cash are more apt to buy recreational land in an expensive land market, when the income necessary to purchase a property is higher than ever before, and secondly, high mortgage rates make buying land in cash and avoiding interest altogether more attractive.

The Rise of Rural Living

With more Americans prioritizing quality of life, rural areas offer the ideal balance of affordability and space. Buyers are drawn to these locations’ privacy and flexibility, making them increasingly attractive for permanent residences, vacation retreats, or investment opportunities.

With the ability to work from anywhere, people can choose a location that better suits their needs, like a more rural area with more space. Remote work encourages people to sell because it gives them the flexibility to live anywhere, potentially leading them to move to a different location with a more desirable lifestyle or lower cost of living, which may necessitate selling their current property.

Donald Trump’s second term promises many changes to the real estate market. His proposals to ease regulations and open federal land for new development could help improve supply and affordability.

A lot might change over the next four years. If you’re searching for land for sale or looking to sell land, it’s especially important to stay informed, talk with your agent, and not lose sight of finding your dream property.

Do you have a suggestion for next month’s Pulse question? Submit your question and we might choose yours!

This content may not be used or reproduced in any manner whatsoever, in part or in whole, without written permission of LANDTHINK. Use of this content without permission is a violation of federal copyright law. The articles, posts, comments, opinions and information provided by LANDTHINK are for informational and research purposes only and DOES NOT substitute or coincide with the advice of an attorney, accountant, real estate broker or any other licensed real estate professional. LANDTHINK strongly advises visitors and readers to seek their own professional guidance and advice related to buying, investing in or selling real estate.

When it comes down it’s coming down really bad. There going to be a lot of people in this business doing something else before 2029 when if we’re lucky the big crash happens.