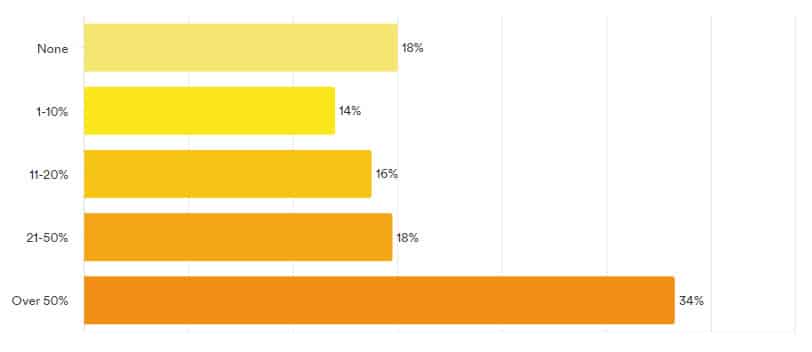

According to the May LANDTHINK Pulse results, 82% of respondents indicated that land was incorporated into their investment portfolio and 34% of respondents said over 50% of their investment portfolio is land. In the wake of the Silicon Valley Bank failure, with inflation rising and a maybe/maybe-not recession looming, many investors are looking for a safe place to put their money.

Last month, the May Pulse asked: What percentage of your investment portfolio is land?

For some, investing in land used to feel like something reserved for the very wealthy, but more and more households are finding land to be an incredibly lucrative addition to their portfolio. Purchasing land has been a good investment, especially in the Southeast, due to the overall market stability over the past several years. If you’ve been considering investing in land, now really is a great time. All types of land for sale have recently seen an increase in demand over the last decade. Land is one of the most stable, tax-friendly investments a person can make and there are many ways that investors can incorporate land into their portfolio.

By understanding your options and doing your homework, you can find a land investment ideal for your portfolio. Whether it’s a farm or ranch, a real estate investment trust (REIT) or a crowdfunding platform that specializes in farmland, a land investment can bolster your financial returns. Here are a few options and how they work.

Real Estate Investment Trusts (REITs)

Real estate investment trusts, or REITs, are companies that own and operate income-producing real estate investments. REITs can be found in multiple real estate sectors, such as farmland and timberland. REITs pool the capital of numerous investors. This makes it possible for individual investors to earn dividends from real estate investments—without having to buy, manage, or finance any properties themselves.

REIT investors can expect regular payouts, while potentially benefiting from long-term holds and taking advantage of value appreciation.

Farmland and timber REITs have been among the best-performing real estate sectors amid concerns over persistent inflation and soaring commodities prices.

For timber REITs, record profitability in 2021 translated into significant dividend growth. With lumber prices again pushing towards record-highs from resilient housing demand, the positive momentum looks poised to continue.

Timber REITs are historically some of the best-performing real estate investments and are excellent options for regular investment income. Most of the top timber REITs are stock market traded, meaning they can be bought and sold like common stock.

Farmland is a stable asset class attractive to investors looking to diversify and hedge against inflation. Farmland REITs hold farmland and allow investors to receive dividends from renting the land to farmers. Farmland REITs can be equity or debt REITs, with equity REITs being more volatile but offering higher potential returns.

REITs are a good option if you want to invest in farmland but don’t want to worry about the day-to-day operations of the farm.

Crowdfunding Platforms

Real estate crowdfunding has increased investment options for the average investor. This type of real estate investment platform boasts a low-maintenance form of passive investing and has a lower barrier of entry compared to traditional real estate.

In recent years, crowdfunding platforms such as Harvest Returns have emerged as a new farmland investment option. These platforms allow investors to pool their money and invest in large tracts of productive farmland. Most of the platforms promise to make investing easy by screening properties and negotiating the deal. The investor simply signs up and sends the money. One of the best parts about crowdfunding investing is that the entire transaction can be carried out online.

Real estate crowdfunding platforms offer investors access to real estate investments that may bring high returns but also carry significant risk. Some crowdfunding platforms are open only to accredited investors, defined as individuals with a net worth, or joint net worth with a spouse, of more than $1 million.

There is one thing to keep in mind with crowdfunding: you’ll have to work to diversify. The platforms’ investments typically are limited to one property growing one type of crop. So if you want geographic diversification and exposure to a variety of types of agricultural products, you’ll need to invest in multiple deals.

Raw Land

For investors who want full control over the development of their assets, raw land investments can be a practical portfolio addition. Land can be subdivided, held or developed into other types of real estate. Owning land, however, can provide more than just a way to generate cash flow.

Some investors earn a profit by holding a piece of land that goes up in market value. Other investors subdivide large lots and sell the smaller sections at a premium. With the right permits, raw land investments can be transformed into commercial or residential rental units.

Buying development land involves a fair amount of market research, especially if you plan to develop the property yourself. This type of investment is best suited to someone with a large amount of capital to invest and a deep knowledge of all things real estate. Be prepared to also research the geological history of the area and learn about a new set of tax obligations.

Recreational Land

Raw land can be used for recreational purposes. You can develop it into a weekend getaway spot, an outdoor family retreat, even a place for camping, hiking, riding ATVs, and much more. It is an affordably priced long-term investment, and comes with a range of both personal and financial benefits. When you invest in recreational land, you get the opportunity to optimize land usage, make money and enjoy using the land while it appreciates in value.

Commercial Development

Commercial real estate is a space that is rented or leased by a business. Raw land can be converted into a warehouse, storage facility, an office building rented by a single business, or a gas station. A strip mall with several unique businesses and leased restaurants are all examples of commercial real estate. Raw land can be converted into an array of things to generate multiple sources of income.

Accessibility, location, and necessities available on or near land are some of the many factors that you must consider.

Ranches, Crop Farmland, Livestock

Becoming a homesteader allows you to directly own your investment in a specific property. Living on and running your farm or ranch business might be your dream come true. However, raising crops and livestock is expensive and risky. To manage this type of investment, you need deep pockets and the ability to shoulder stress.

Agricultural land is typically land devoted to agriculture, but it isn’t limited to crops or livestock. The possibilities are almost endless. For instance, you could cultivate an orchard, vineyard, mineral development land, timber farm or recreational land. Generally, these investments require less up-front capital than crops and also allow you to live on the land.

You can invest in land through raw land and commercial property, or farmland. In addition, you can invest by directly purchasing a farm or ranch, buying shares of REITs, or crowdfunding platforms which give you a diversified slice of the real estate market, spreading risk across numerous assets.

Understanding your investment goals will help you learn which types of real estate investments are right for you.

Staying educated about the changing real estate landscape can expose you to innovative strategies and help you diversify your investment portfolio.

Do you have a suggestion for next month’s Pulse question? Submit your question and we might choose yours!

This content may not be used or reproduced in any manner whatsoever, in part or in whole, without written permission of LANDTHINK. Use of this content without permission is a violation of federal copyright law. The articles, posts, comments, opinions and information provided by LANDTHINK are for informational and research purposes only and DOES NOT substitute or coincide with the advice of an attorney, accountant, real estate broker or any other licensed real estate professional. LANDTHINK strongly advises visitors and readers to seek their own professional guidance and advice related to buying, investing in or selling real estate.

Add Comment