As trees grow, they absorb carbon dioxide from the atmosphere. This capturing of “forest carbon” is one modest part of a major transformation in how we produce and source energy. In this shift from fossil fuels towards renewables and conservation, each standalone piece does not determine a known energy future. Rather, everything supports a process of continuously upgrading the planet’s energy portfolio.

Investment Implications and Challenges

A portfolio framework for forest carbon resonates for investors of all types. Just as we might improve a timberland portfolio by replacing the lowest performing acres with more productive ones, we work to raise the average performance and reduce the negative externalities of industrial power generation. Conversations with long-term investors and experienced researchers confirm that here are no “silver bullets” in this story.

However, forest carbon markets are not without their critics or challenges. Forest carbon, as with the advocacy of forest biomass as a renewable energy source, faces continued scrutiny. This leads to uncertainty for timberland investors. Two speakers at the 2023 Forest Landowner Association’s National Conference in June addressed this directly, providing context and resources for forest owners and investors.

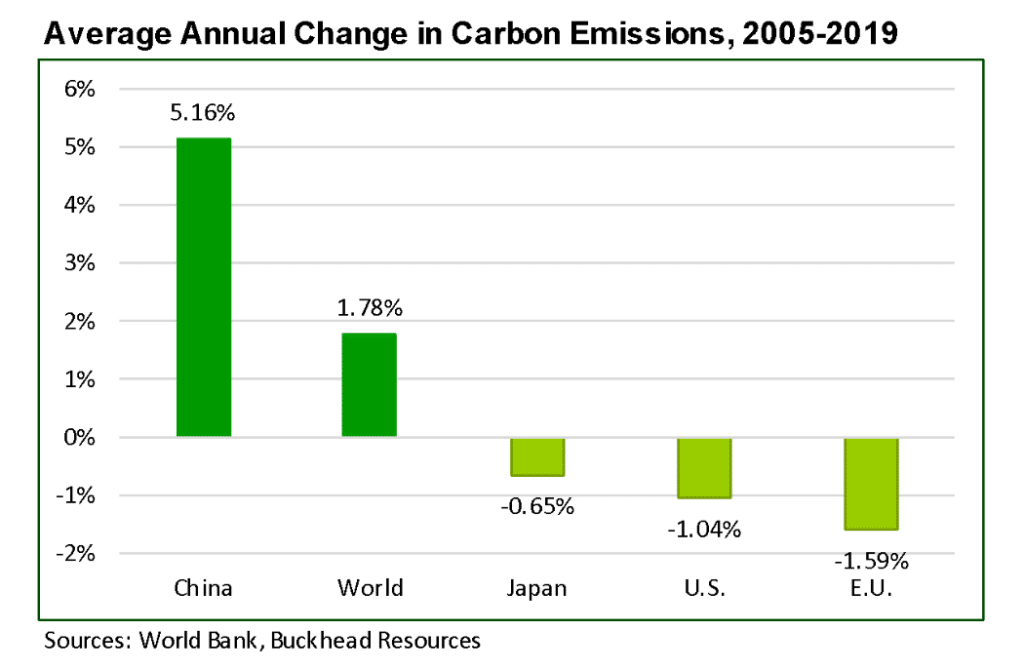

Richard Hall of Buckhead Resources emphasized the ability to measure baselines and change to track performance and determine units of value. In addressing, “Do forest carbon markets work?”, he shared data that showed the average annual change for multiple geographies (Figure). Trading systems in the European Union, for example, do affect behavior. He noted how forest owners “benefit by having a working knowledge of their own carbon resources and the market options available to them.”

Professor Melissa Kreye of Penn State followed with more helpful context, noting that most forest carbon (~95%) is in standing trees, versus wood products. In addition, the major benefit of forest carbon efforts comes through wood products displacing other materials, such as steel. [For additional forest carbon resources, visit Penn State Extension’s site for Family Forest Owners.]

Thinking in terms of the overall portfolio, forest carbon markets are largely based on averages, with the goal of raising the average forest age, forest inventory, forest coverage, and the average use of wood relative to other building products. When we consider these in the context of also improving the average returns and productivity of our forest investments, we can define success as improving each one of these on the margin over time.

This content may not be used or reproduced in any manner whatsoever, in part or in whole, without written permission of LANDTHINK. Use of this content without permission is a violation of federal copyright law. The articles, posts, comments, opinions and information provided by LANDTHINK are for informational and research purposes only and DOES NOT substitute or coincide with the advice of an attorney, accountant, real estate broker or any other licensed real estate professional. LANDTHINK strongly advises visitors and readers to seek their own professional guidance and advice related to buying, investing in or selling real estate.

Wouldn’t increasing forest inventory & age be mutually exclusive to increasing usage of wood?

Not necessarily, as pulp markets decrease and sawtmber markets increase, timber owners benefit by longer rotations.

My problem (in simplistic terms) with the current carbon market programs is that companies buy credits to “offset” their contributions to pollution. Landowners (timber owners) can sell credits on their standing timber by agreeing not to harvest said timber – in most cases timber that they had no intention of selling anyway. Landowners get a nice windfall and polluters get to keep polluting. With the current timber market being in the tank, owners didn’t want to cut anyway. When they are ready, they simply don’t participate in the carbon market for that particular year. In the long run, it’s a game that benefits the polluters and the timber owners but ultimately has zero impact on the environment.

Absolutely go back to 4 th grade science. Climate scam!

Carbon capture is a scam per 3rd grade science. Enough with climate crisis bs its all about money and control. Wind farms to. Total scam.