The forest industry often experiences a version of the “Tuesday-Wednesday problem,” where good news one day is followed by difficult news the next. In 2023, while housing starts slightly exceeded expectations, projections for housing in 2024 are down. While energy and fuel prices eased, prices and demand for many end products fell. To learn from the current situation and explore niche markets related to timber investments, this article summarizes recent Forisk analysis on acreages associated with solar leases.

Solar Leases and Forest Supplies

Solar leases increasingly appear in discussions related to timberland markets and transactions. Clients ask, “to what extent could solar leases affect forest supplies?” Analysis by the Great Plains Institute two years ago found that active and proposed solar projects account for small percentages of land and represent “minimal risk to the economic base of agricultural communities, as measured by land conversion.”

Forisk Project Manager Matt Camp, with the help of Forisk intern Parker Peagler, revisited this question to provide analysis relevant to timberlands. A key metric is the “Area Factor”, or acres per megawatt (MW) for solar farms. Based on analysis of spatial data, as well as the nameplate capacity for announced and active solar projects, we estimate the Area Factor for U.S. solar projects is around seven (7) acres per MW.

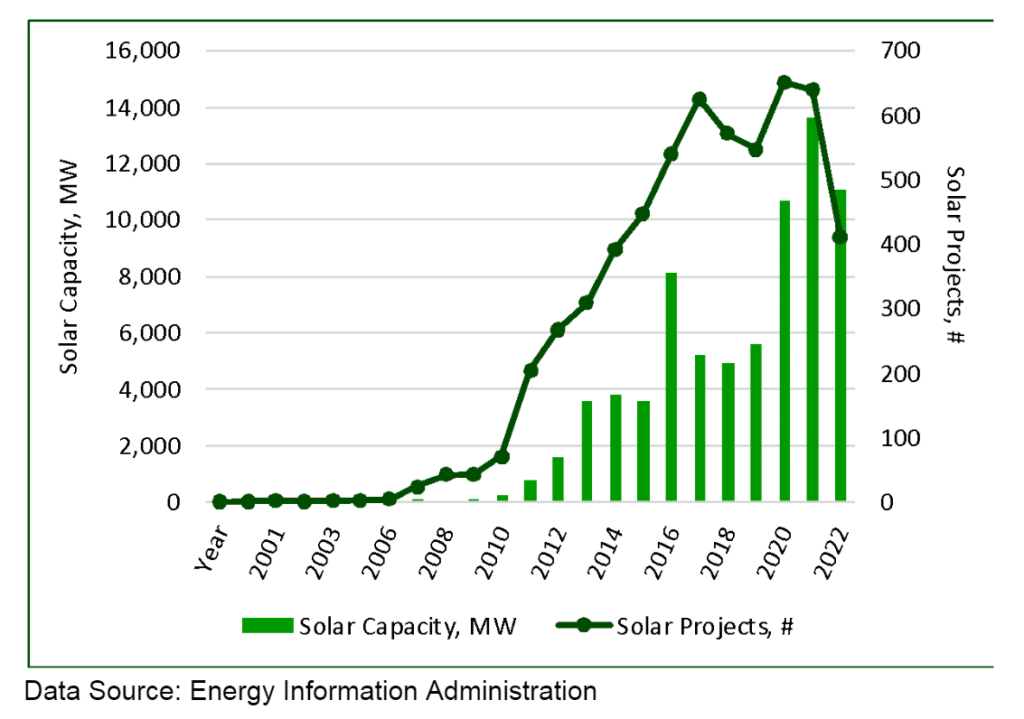

Data from the Energy Information Administration provides context for solar project trends (Figure 1). Overall, the explosive growth began slowing before and during COVID, though the national picture does not shed light on the impact to timberlands.

Figure 1. Solar Projects and Nameplate Capacity in the U.S.

To do that, our team did state-by-state analysis of solar projects to assess the acreages by type (e.g. agriculture, timberland, non- productive) utilized for solar projects. Overall, solar projects largely comprise agriculture acreages (close to 60%) while forests account for about a third. We evaluated one heavily forested state in the South, West and Northeast to provide better estimates of the actual number of forested acres involved:

- Georgia: solar projects affect ~7,700 timberland acres (and approaching 20,000 acres in all).

- Oregon: solar projects affect ~3,600 timberland acres (and over 5,000 acres in total).

- Vermont: solar projects affect fewer than 400 timberland acres (and fewer than 1,000 acres in total).

In sum and to date, solar projects have a marginal and modest impact on forest acres.

Forestry and timberlands attract entrepreneurs looking to build new businesses related to bioenergy, biofuels, and (renewable) solar. However, forestry does not scale like oil, agriculture, or technology, so it benefits our teams and clients to take a breath when pitched new ideas. By evaluating the available data and comparing to our understanding for how timber-related business models work “on the ground,” we can support and implement better investment decisions.

This content may not be used or reproduced in any manner whatsoever, in part or in whole, without written permission of LANDTHINK. Use of this content without permission is a violation of federal copyright law. The articles, posts, comments, opinions and information provided by LANDTHINK are for informational and research purposes only and DOES NOT substitute or coincide with the advice of an attorney, accountant, real estate broker or any other licensed real estate professional. LANDTHINK strongly advises visitors and readers to seek their own professional guidance and advice related to buying, investing in or selling real estate.

Add Comment