The Forest History Society just published “Wood for Bioenergy: Forests as a Resource for Biomass and Biofuels” by Forisk researchers Brooks Mendell and Amanda Lang. A central theme in the book is the critical importance of understanding and accounting for local factors when making wood and timber-dependent investments. This article summarizes research that applies this principal to international timberland investing and to US wood bioenergy markets.

Overseas Discount Rates for Timberlands

Like quarterbacks with respect to winning and losing football games, discount rates get a disproportionate level of credit and criticism with respect to the success and failure of timberland investments and valuations. While simple math tells us that changing discount rates critically affects any valuation model, basic finance and market analysis remind us that client objectives, timeframes and risk tolerance drive investment strategies when attempting to value timberland assets. This is especially true when evaluating international timberland investment opportunities.

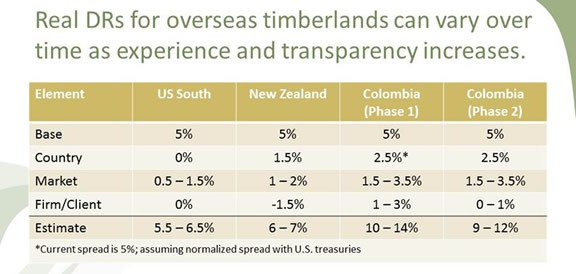

The “comfort” of clients and their asset managers with doing business in a given country can be more important than the availability and quality of available forestry assets in that country. Investors commonly “build-up” discount rates to account for a range of asset and market-specific issues. For example, the relevant layers may include the basic hurdle rate, country risk to account for regulatory or political concerns, market risk specific to the local or regional wood markets and firm or client risk to account for client comfort and execution concerns (see figure).

Multiple approaches can address each layer. Country risk can start with the spread between ten-year US treasuries and long-term bonds of the foreign country. Market risk can vary by country and investment vehicle. Also, firm/client risk can change over time. Investors may use a higher discount rate in the early years of a first, greenfield investment to account for the initial establishment and execution risk, and then apply a normalized discount rate for the duration of this and other investments in the country.

How Do Wood Bioenergy Markets Affect Local Stumpage Prices?

Foresters and timberland owners in Texas could care less about wood bioenergy projects in Florida or Georgia. Why? Because wood bioenergy markets impact timberland investments and the forest products industry at the local level. The uncertainty of new project announcements requires project-by-project assessments and assumptions to estimate the potential impacts of bioenergy projects on stumpage prices in local timber markets. In the September issue of Wood Bioenergy US (WBUS), we explore two bioenergy-related variables as they affect stumpage price projections: project risk and feedstock volumes by type.

An analysis of six scenarios of announced and operating biomass projects in Alabama/Mississippi revealed that assumptions regarding project viability affect stumpage prices to a greater degree than assumptions regarding feedstock mix.

We evaluated a case study for Alabama/Mississippi, in which only 32% of currently announced and operating projects pass viability screening. Modeling feedstock mix requires assumptions related to the percent of pulpwood versus logging residues versus other forestry volumes and urban wood wastes. Overall for the Alabama/Mississippi case, assumptions related to project risk and viability had 6.7 to 7.2 times more impact on forecasted stumpage prices than did assumptions related to feedstock types.

Timber and wood bioenergy markets are uniquely local and local experience is hard-earned. Due diligence work for international timberland investments require the quantification of these realities in valuation models and investment timelines. Procuring wood and wood bioenergy investments require a deep understanding of project viability, regardless their feedstock types. A systematic, repeatable approach to screen bioenergy project risk and timber markets provides a transparent and flexible process for testing different assumptions.

This content may not be used or reproduced in any manner whatsoever, in part or in whole, without written permission of LANDTHINK. Use of this content without permission is a violation of federal copyright law. The articles, posts, comments, opinions and information provided by LANDTHINK are for informational and research purposes only and DOES NOT substitute or coincide with the advice of an attorney, accountant, real estate broker or any other licensed real estate professional. LANDTHINK strongly advises visitors and readers to seek their own professional guidance and advice related to buying, investing in or selling real estate.

Add Comment