The old joke, “Why did the sawmill owner sell his mill? Because he was board,” does not apply to hardwood lumber operations. U.S. hardwood lumber production and consumption continues to accelerate. Total hardwood lumber supplies, including imports, increased 19.0% in 2014 after increasing 13.2% in 2013. Of the total volume available in the United States in 2014, U.S. producers accounted for 94.6%. Holy hardwood, Batman!

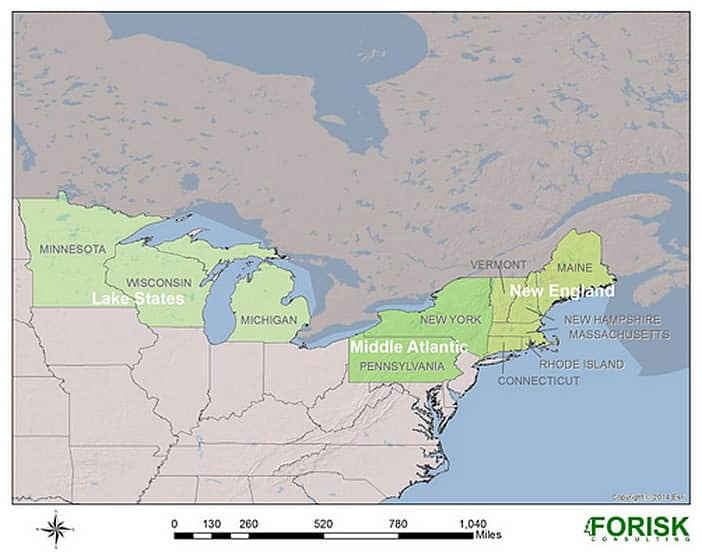

This raises the question about timberland investments that prioritize hardwood species. Outside of hardwood forests in the South or Appalachia regions, many opportunities and working hardwood forests operate in the Northeast and Mid-West. To support quarterly hardwood log forecasts, Forisk tracks and studies three multi-state hardwood markets (regions) in the U.S. North (map below). How do these markets differ?

Comparing Hardwood Log Markets in the U.S. North

Unlike the simple set of core pine products – sawtimber, chip-n-saw and pulpwood – that drive most timber markets across the South, the hardwood markets of the North feature varying species and grades across clumpy, seasonal markets that use different log scales that complicate comparisons across space and time. [Now say that out loud five times fast.]

These markets, in total, have at least 421 open hardwood lumber mills that average less than 5 million board feet in annual production each. That means lots of small, lower volume markets dot the landscape, and each has particular preferences and priorities for the types, grades and volumes of logs they buy. This helps explain why the three markets discussed here have distinct profiles with respect to core species, pricing and mills. For example:

- The Lake States region has the largest number of mills, and the highest percent of cottonwood and aspen hardwood forest inventories. In 2014, red oak, maple and yellow birch logs traded at five-year highs.

- In comparison, the Middle Atlantic region has the most hardwood sawmill capacity (and a larger average mill size). Soft maple, red oak and hard maple account for nearly half of the total hardwood forest inventory on timberland. In 2014, hard maple traded near its five-year high.

- New England, on the other hand, has the smallest hardwood sawmill market and largest wood bioenergy market of the three. Soft maple, red oak and hard maple account for more than half of the hardwood inventory. In 2014, red oak, hard maple and ash traded near five-year highs.

For timberland investors interested in hardwoods, these realities and differences simply highlight the importance of understanding (1) the exact species and grades of logs growing on the candidate properties relative to (2) the specific preferences and health of the hardwood mills operating within an economically feasible distance for doing business.

This content may not be used or reproduced in any manner whatsoever, in part or in whole, without written permission of LANDTHINK. Use of this content without permission is a violation of federal copyright law. The articles, posts, comments, opinions and information provided by LANDTHINK are for informational and research purposes only and DOES NOT substitute or coincide with the advice of an attorney, accountant, real estate broker or any other licensed real estate professional. LANDTHINK strongly advises visitors and readers to seek their own professional guidance and advice related to buying, investing in or selling real estate.

Unfortunately the highs in the hardwood markets, here in the New England region, are behind us. The summer of 2014 saw the highest stumpage rates paid for Vermont hard maple and Eastern NY Red& White Oak that I had seen since the market implosion of early 2009. A number of respected mill owner sources have told me that what they are facing here in early 2015 is eerily similar to what they experienced in 2009. Its really a bear market for the sale of hardwood lumber. The overall world economy is so anemic that it just cannot support the massive production of hardwood that continues to take place. With the end product being a durable good – the extra money, particularly here in the West, is not available among the middle class to purchase such products. Money that, in the past would have gone to buying a cherry coffee table is now being used to buy food and gas for the car.