Forisk’s research includes an ongoing program related to timberland ownership, investment vehicles, and transactions across North America. Matt Camp, who helps manage this program at Forisk, recently analyzed transaction trends over the past ten years to offer context for 2023. In this post, I summarize findings and data from Matt’s analysis.

2023: Historically Low Volumes

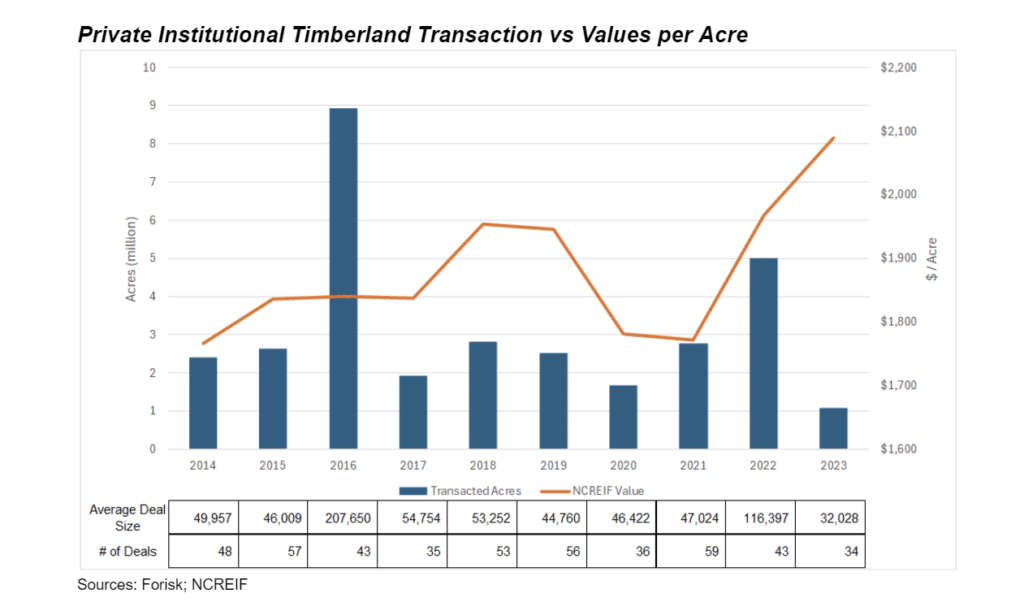

Institutional timberland transactions tracked by Forisk in the United States and Canada totaled just over 1 million acres in 2023, well below the 2 to 2.5-million-acre annual average over the past decades. Even relative to the past ten years, 2023 stands out. The figure below shows total acres transacted by year, in deals of at least 1,000 acres each, from Forisk’s Timberland Transaction database. In addition, the figure includes the implied per acre value of institutional timberland, representing acres managed by timberland investment management organizations (TIMOs), from the NCREIF Timberland Index.

Let’s begin by offering context. The data from 2016 stands out, and the reason is that it includes 6.3 million acres from the Weyerhaeuser/Plum Creek merger, which distorts the normal trend. In addition, the 2022 data includes The Forestland Group’s sale of 1.7 million acres to Blue Source Sustainable Forests (now Aurora Sustainable Lands) as well as The Ontario Teachers’ Pension’s redemption transaction of 870,000 acres from Resource Management Services. These events remind us that, relative to other real estate classes such as commercial and residential, the timberland sector is “chunky” as single, large transactions affect the market.

Lessons from 2023 and Looking Forward

What can we learn from the data with respect to 2023 and the past decade? Was last year an anomaly or a sign of what’s to come? A few observations:

- Large deals inject inconsistency with respect to the pace of timberland transactions, often skewing results and trends. The same can be said for low volume years such as 2023. In both cases, the average deal size also tends to trend up and down with total annual volume.

- Timberland transactions can take a long time to finalize and close, and numerous factors can affect the timing, which can further change terms and move closing dates.

- Rapidly rising timberland values, as tracked and reported by NCREIF, has likely caused buyers to revisit their math, especially with respect to large deals in a period of higher interest rates relative to five or ten years ago.

In talking with forest industry contacts and timberland investors, we find these observations align with both our data and their sentiment. While 2022 was a big year, the market did not view the 2023 drop in volume as alarming. The high valuations are leading buyers to proceed cautiously, though there does seem to be adequate, available capital searching for timberland acquisitions. Finally, demand remains strong as multiple players are engaged in due diligence and advancing deals. As we move to the middle of 2024, a number of significant transactions are pending, indicating that transaction volume will likely rebound in 2024.

This content may not be used or reproduced in any manner whatsoever, in part or in whole, without written permission of LANDTHINK. Use of this content without permission is a violation of federal copyright law. The articles, posts, comments, opinions and information provided by LANDTHINK are for informational and research purposes only and DOES NOT substitute or coincide with the advice of an attorney, accountant, real estate broker or any other licensed real estate professional. LANDTHINK strongly advises visitors and readers to seek their own professional guidance and advice related to buying, investing in or selling real estate.

A 3 yr moving avg on the graph might suggest the trend a little better. It’s interesting that as capital costs have increased, the $/acre has too. I’m having trouble with that. Perhaps it is reflective of one high value transaction that dominated the 2023 transactions.