When localizing forest supplies, mill capacities, forest operations, and pricing, each timberland asset and market produce a unique profile. This uniqueness highlights how timberland valuations, wood procurement strategies, and forest management plans get customized to optimize the market and the forest. In developing ways to track key factors systematically, we recommend tracking local wood demand by mill and by firm. If a local timber market has ten mills, but all are owned by one firm, how competitive is your market?

Customizing Market Analysis

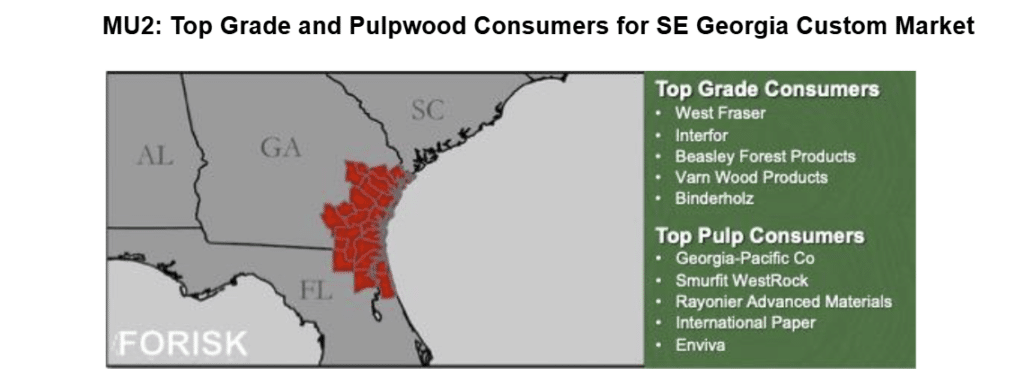

As an example, Forisk’s Custom Market Forecast (CMF) includes a dashboard-style report and data file with price (cost) forecasts for client-specific timber markets and wood baskets. The CMF builds in other strategic metrics such as forest supplies, growth-to-drain, and annualized growth rates, as well as the top five grade and pulp consumers in the market. Recently, we analyzed a Southeast Georgia market, which included the following map and top consumers, at the firm level, by product (Figure).

Why is tracking wood markets at the firm level helpful? For timberland investors, owning or acquiring profitable timberland relies on deep and increasing demand for logs in local markets populated with multiple firms. This is “good” because it offers competitive conditions for higher timber prices and, ultimately, better investment returns. Alternately, for grade-using mills, wood baskets with stable competition, possibly concentrated in fewer firms, implies less potential upward pressure on log prices over time.

Our research and client experience find that timberland investors prefer and benefit from situations where no two firms combined account for 50% or more of the wood demand for grade. Alternately, grade consumers prefer situations that have fewer competitors. In sum, market concentration speaks to different risks for timberland owners and wood consumers. Therefore, it helps to track the aggregate demand at the firm level over time.

This content may not be used or reproduced in any manner whatsoever, in part or in whole, without written permission of LANDTHINK. Use of this content without permission is a violation of federal copyright law. The articles, posts, comments, opinions and information provided by LANDTHINK are for informational and research purposes only and DOES NOT substitute or coincide with the advice of an attorney, accountant, real estate broker or any other licensed real estate professional. LANDTHINK strongly advises visitors and readers to seek their own professional guidance and advice related to buying, investing in or selling real estate.

Add Comment