How many researchers does it take to change a light bulb? Actually, it just takes one, but you’ll have seven others standing around debating about the correct methodology. And that brings us to a challenge with investment data and research: if we think a data set or analysis “should” exist, it often doesn’t. And if it does exist, it’s probably out of data (especially in forestry). Therefore, my team at Forisk views the systematic aggregation, tracking and analysis of facts related to timberland markets and wood bioenergy as fundamental to forestry investment research.

That said, what’s going on out there?

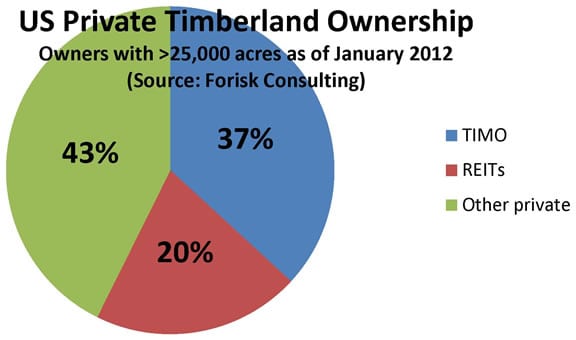

US Timberland Ownership Led by Private Firms

Part of Forisk’s timberland investment research focuses on how private timberland ownership changes over time. Estimates of the “investable universe” of timberland in the US range from 60 to 100 million acres; we count approximately 210 owners that each own and manage 25,000 acres or more for a total of ~82 million acres. Of these acres, 20% are owned by the four public timber REITs (Plum Creek, Potlatch, Rayonier and Weyerhaeuser) and 37% are managed by 27 US-based timberland investment management organizations (TIMOs). The 43% of acres associated with “other private” owners include forest industry firms, private individual and families, conservation groups and other non-forest industry firms and institutions.

The top 300 timberland owners and managers in the US account for nearly 84 million acres of private timberlands in the North, South, and West. The top 10 alone account for 32.5 million acres. Detailed analysis of these ownership groups highlight the continued shifting of acres to institutions, and the increased activity by private individuals and “family offices” in timberland markets.

Bioenergy Projects Looking for “Solid Ground”

The wood bioenergy sector in the United States continues its extended round of musical chairs. As of January 30, 2012, Wood Bioenergy US reports that projected wood demand for all announced projects in the U.S. dropped 7.4 million tons year-to-date, a 6% decrease since December 2011. This is largely attributed to the removal of several large biomass co-fire projects from the Wood Bioenergy US database, particularly in Ohio. Utilities claim that biomass remains uncompetitive with other alternative compliance options (note: natural gas). Also, some coal units are scheduled to shut down to meet EPA MACT requirements.

In liquid fuels news, the USDA granted ZeaChem a conditional commitment for a $232.5 million loan guarantee from the 9003 Biorefinery Assistance Program. The loan guarantee could help fund a 25 million gallon/year commercial biorefinery. ZeaChem plans to build the commercial biorefinery at the same site as its demonstration plant in Boardman, OR. Elsewhere, LanzaTech purchased the former Range Fuels site in Soperton, GA for $5.1 million in a foreclosure auction. The company plans to use wood residues to produce fuels and chemicals.

Enviva’s first shipment of pellets left from the Port of Chesapeake on December 31. The vessel, bound for Europe, contained 28,000 metric tons of wood pellets. Enviva began operations at the Ahoskie pellet plant in November. Two additional plants are in the planning stages in North Carolina and Virginia; both will also use the same port.

Meanwhile, demand for wood from traditional forest industry users has remained flat as manufacturers look to better housing news in 2012 and 2013. Also, the pulp and paper industry continues to enjoy strong markets and productivity.

Demand for Timberland Remains Strong

One fact continues to percolate up during our ongoing timberland market research: demand for timberland assets remains strong from institutional investors and forest industry firms. After decades of timberland divestitures, forest industry firms are reevaluating the options associated with acquiring timberlands to support raw material needs and to address the question “what’s the best use of our investment capital in 2012?”

This content may not be used or reproduced in any manner whatsoever, in part or in whole, without written permission of LANDTHINK. Use of this content without permission is a violation of federal copyright law. The articles, posts, comments, opinions and information provided by LANDTHINK are for informational and research purposes only and DOES NOT substitute or coincide with the advice of an attorney, accountant, real estate broker or any other licensed real estate professional. LANDTHINK strongly advises visitors and readers to seek their own professional guidance and advice related to buying, investing in or selling real estate.

I read your article with great interest, as I am very interested in timberland values. Perhaps you can help me out or point me in the right direction. I am a forester in the United Country network, and we have been approached by a New England pension fund looking for a timber investment. They have determined that timberland is an undervalued asset, that the average CAPM for timber is perfect for their portfolio, and hence they asked us to find a suitable property, preferably in the Southeast. Minimum budget $15M, however they would prefer something two or three times that. Any suggestions as to where I can obtain such a property?