How might wood bioefuel projects affect wood demand and timber markets for timberland investors in the United States? After all, wood biofuel projects attract strong private and public investment, and advance federal energy policy objectives such as the Renewable Fuel Standard which requires that 8% of all fuel used in the US come from renewable sources in 2011. Forisk and the Schiamberg Group recently completed a study that details the 36 projects in the United States that convert wood to fuels.

What is the context for the wood biofuels market? In 2010, foreign and domestic producers supplied nearly 7 billion barrels of petroleum products, including 3.3 billion barrels of motor gasoline, to US markets. The barrels of motor gasoline translate into 379 million gallons of gas used per day in the United States. Fuel ethanol, an alcohol fuel made from corn and other renewable sources of biomass, represented another 36 million gallons per day (9.5%) to US markets. Fuel ethanol accounts for a small but growing source of “renewable” transport fuel for US consumers.

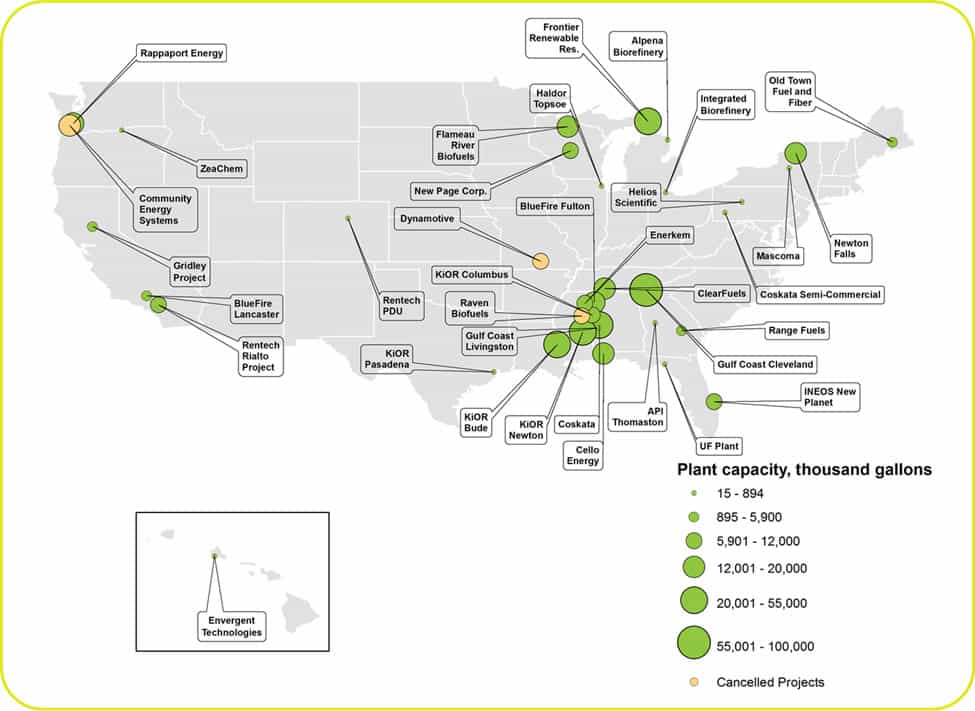

In evaluating the 36 projects in the United States, we identified 12 technologies in use and under development for the conversion of wood to transportation fuels including ethanol, butanol, diesel, gasoline, and jet fuel. For each technology, we evaluated and ranked the level of technical risk, estimated a commercialization timeline, and estimated the expected yields at commercial scale. Our results indicate that major technical hurdles need to be solved and will delay or disrupt commercialization for most of the technologies under development across the 36 projects.

What are implications for timber markets and timberland investors? The overall, potential impacts from this sector appear modest, though specific local markets could benefit within the next ten years. On a national scale, demonstration and commercial projects could use up to 8.8 million dry tons of wood per year by 2030. According to project announcements, this total wood demand would occur by 2018. A commercialization scenario projects 8.8 million dry tons of wood per year 11 years later in 2029. In other words, we estimate an 11 year lag between when the projects expect to operate and when our technology analysis indicates the technology could overcome hurdles and be viable at commercial scale.

The study models and graphs data for all US regions: the US South dominates the potential incremental wood use from the transportation fuel projects evaluated. At the most basic unit of analysis, the local wood basket circling each liquid fuel project, the population of timberland owners and investors with significant exposure to potential increases in raw material demand from announced projects would include those with timberland investments in markets that include lower risk, higher potential projects. These markets include Alabama; California; Michigan; Mississippi; and Tennessee.

Projects producing drop-in fuels have superior potential for investors. However, wood-based biofuels will fail to contribute substantively to EPA’s Renewable Fuel Standard targets in 2011 or 2022, as firms continue to struggle with applying technologies at commercial scale with competitive yields.

About the study

For more information about the study, Transportation Fuels from Wood: Investment and Market Implications of Current Projects and Technologies, visit www.forisk.com and click “Wood Bioenergy US.”

This content may not be used or reproduced in any manner whatsoever, in part or in whole, without written permission of LANDTHINK. Use of this content without permission is a violation of federal copyright law. The articles, posts, comments, opinions and information provided by LANDTHINK are for informational and research purposes only and DOES NOT substitute or coincide with the advice of an attorney, accountant, real estate broker or any other licensed real estate professional. LANDTHINK strongly advises visitors and readers to seek their own professional guidance and advice related to buying, investing in or selling real estate.

Brooks, this is a good synopsis, and it seems like the technology hurdle is taking a lot longer to clear than the promoters of these emerging businesses would like us to believe. One thing that makes these business models tough for fuels from biomass is that you can only reasonably truck the feedstock about 75 miles, so economy of scale at a plant is a huge concern. It could be a good economic boost for the southeast if this industry matures.

We have got to move away from our dependence on foreign oil, and corn ethanol is not a good alternative either. Wood-based ethanl could make sense.

Thanks again for sharing this article with us.

Sounds like a good idea. I have 30 acres I want to cut and replant.