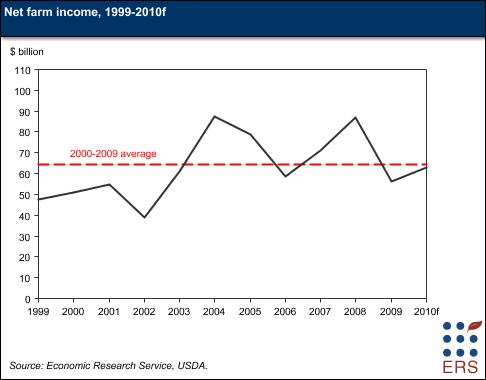

USDA released its 2010 farm income forecasts last week. While net farm income is expected to be $63 billion in 2010, up almost 12 percent ($6.7 billion) from 2009, that number is $1.4 billion below the average of $64.5 billion in annual net farm income earned in the previous 10 years.

Agriculture’s future seems to be a growing forest, with some trees in trouble.

Net cash income, which reflects the current year’s production whether or not sold in that year, is projected to gain almost 8 percent ($5.5 billion) up from 2009’s $76.3 billion. Net cash income reflects farm solvency—the ability pay bills and debt. Net farm income reflects an increase in wealth from production.

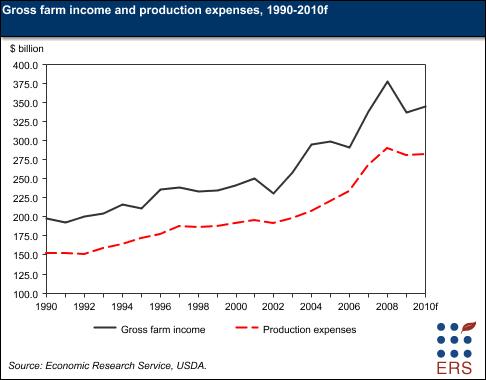

Total production expenses in 2010 are forecast to rise to $281.4 billion, only $0.7 billion higher than 2009’s forecast. Expenses rose $99 billion from 2002 to 2008, but have temporarily leveled off. Fuel and property taxes are expected to rise, but feed, fertilizer, lime and interest are expected to decline.

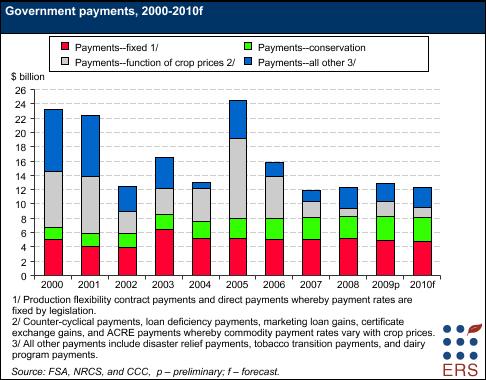

Direct government payments to farms will decline from about $12.898 billion in 2009 to about $12.362 billion in 2010.

As always, there will be gainers and losers year to year in the farm economy. Both crop and livestock production values have trended up for the last 40 years, though each sector has witnessed good years and bad years during that period.

For 2010, total crop receipts are forecast to drop $6 billion, following a decline of $16.8 billion in 2009. Crop receipts are projected lower across the board, except for small increases in cotton and greenhouse/nursery products. Livestock receipts are expected to increase $11.5 billion in 2010.

The USDA also released recently its agricultural baseline projections, which provide 10-year projections for agricultural commodities, prices and farm income. Income and production are projected to trend up from a weak start in the early years of the 2010-2019 decade. Sustained biofuel demand and global food demand are projected. Direct government payments are projected to flatten out at about $10 billion a year.

The long-term positive trend in receipts for both crops and livestock has driven the corresponding long-term upward trend in agricultural land values—crop, pasture and timber.

Macro-level trend values don’t show the shifts within the farm economy to a greater concentration of production and income in the largest farms. Middle-size farms — the ones that are associated in the public consciousness with “the family farm” — are declining in number.

The 2007 Census of Agriculture counted 2.2 million farms, a net gain of almost 76,000 farms over 2002. The trend is toward more small and more very large farms. Between 2002 and 2007, the smallest farms — with sales of less than $2,500 annually — grew by 74,000. Those with sales of more than $500,000 grew by 46,000.

Middle-sized farms of several hundred acres have a hard time making it with conventional crops. They may, however, be better scaled to organic/natural products, which are a strong growth sector.

The 2008 Organic Production Survey released in early February found 14,540 farms that were either USDA certified organic or exempt from certification with sales totaling less than $5,000 annually. They amounted to 4.1 million acres, of which 1.8 million were pasture/range, and the rest crop land.

Organic production totaled $3.16 billion in 2008. Organic farms had an average of $217,700 in sales and expenditures of $171,800 in 2007, compared with $134,800 in sales and $109,400 in expenditures for the average U.S. farm.

Buyers of small farms with diversified specialty products — organic, grass-fed, direct-marketed — have a shot at making a little money from their efforts. The largest farms have the best shot. I would be very hesitant about buying a 300 to 400-acre dairy farm with 100 cows or a corn-and-cattle farm of about the same size.

This content may not be used or reproduced in any manner whatsoever, in part or in whole, without written permission of LANDTHINK. Use of this content without permission is a violation of federal copyright law. The articles, posts, comments, opinions and information provided by LANDTHINK are for informational and research purposes only and DOES NOT substitute or coincide with the advice of an attorney, accountant, real estate broker or any other licensed real estate professional. LANDTHINK strongly advises visitors and readers to seek their own professional guidance and advice related to buying, investing in or selling real estate.

Add Comment