Good questions clarify our context, risks, and options. Well-structured questions reveal new information and potential next steps. They help distinguish the important, relevant, and actionable from the unsubstantiated and uncontrollable. A quality question requires prioritizing issues and supports decision-making. This is especially true when considering any expense in a forest management plan or investment into a timberland property.

Three Types of Finance Questions

In forest finance, and in finance generally, three sets of questions organize our efforts to screen and rank investments and potential projects:

- One, how do we identify, screen, and value timberland acquisitions or forest management decisions? These deal with the “investment decision” and includes proper valuation (appraisals) and the ranking of different forest management plans or timberland properties.

- Two, how do we pay for this investment? This is the “financing decision” and includes the relative advantages and disadvantages of using debt, cash, or equity, especially in situations where we are closely managing cash flow.

- Three, how and when is the best time to sell a property, or to harvest timber? These questions comprise the “exit decision” and center on the timing of key activities. As markets change, we want to maintain flexibility and have the ability to change a plan supported by a clean piece of analysis.

To answer these questions, we apply specific discounted cash flow (DCF) tools to make the “best” investment decisions possible. These tools depend on two economic concepts. One, we prefer more money rather than less. Two, we prefer dollars today rather than dollars tomorrow. These principles from “utility theory” hold for everyone from kindergarteners to investment bankers; they help explain all basic financial criteria related to investing.

Questions for Forest Investments

Most questions in forest finance flow from these economic concepts while tending to fall in the “investment” and “exit” decision buckets. Discounted cash flow (DCF) criteria – such as net present value (NPV), internal rate of return (IRR), and bare land value (BLV) – satisfy these economic principles through quantifying the time value of money and investor opportunity costs. They provide systematic ways to organize our data and thinking.

That said, my experience is that investment errors are less a function of misunderstanding economic theories and more associated with asking poorly defined questions, making unsupported assumptions, and missing simple spreadsheet errors. While we cannot control the state of the global economy and its impact on our investments and firms, there remain many things we can control when it comes to choosing where to invest our capital, starting with how we define the key question.

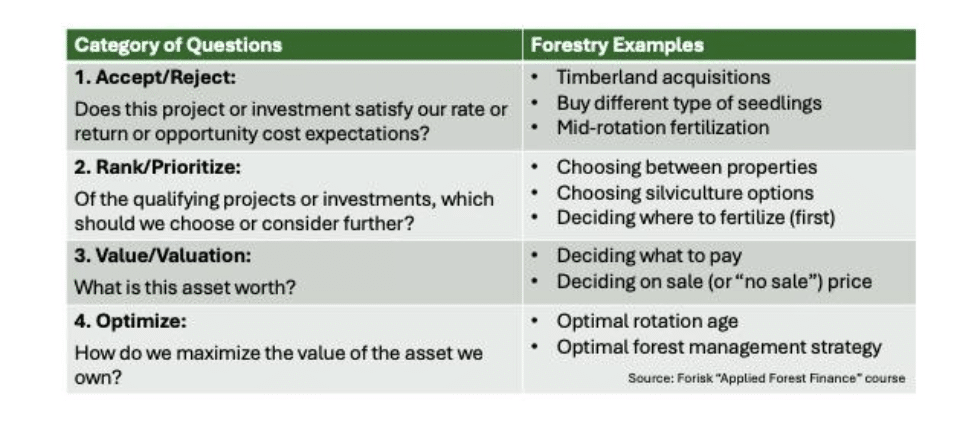

In forestry, we can organize fundamental investment questions into four categories, and each category addresses specific investment and operational issues:

When deciding where to invest the capital we earned and saved, we benefit by systematically applying available criteria for identifying, ranking, and optimizing the available options. Choosing which financial criterion to use depends on the question we’re asking.

This content may not be used or reproduced in any manner whatsoever, in part or in whole, without written permission of LANDTHINK. Use of this content without permission is a violation of federal copyright law. The articles, posts, comments, opinions and information provided by LANDTHINK are for informational and research purposes only and DOES NOT substitute or coincide with the advice of an attorney, accountant, real estate broker or any other licensed real estate professional. LANDTHINK strongly advises visitors and readers to seek their own professional guidance and advice related to buying, investing in or selling real estate.

Add Comment